Basking.io Raises Investment from Blue Field Capital, Aconterra and Ray Wirta

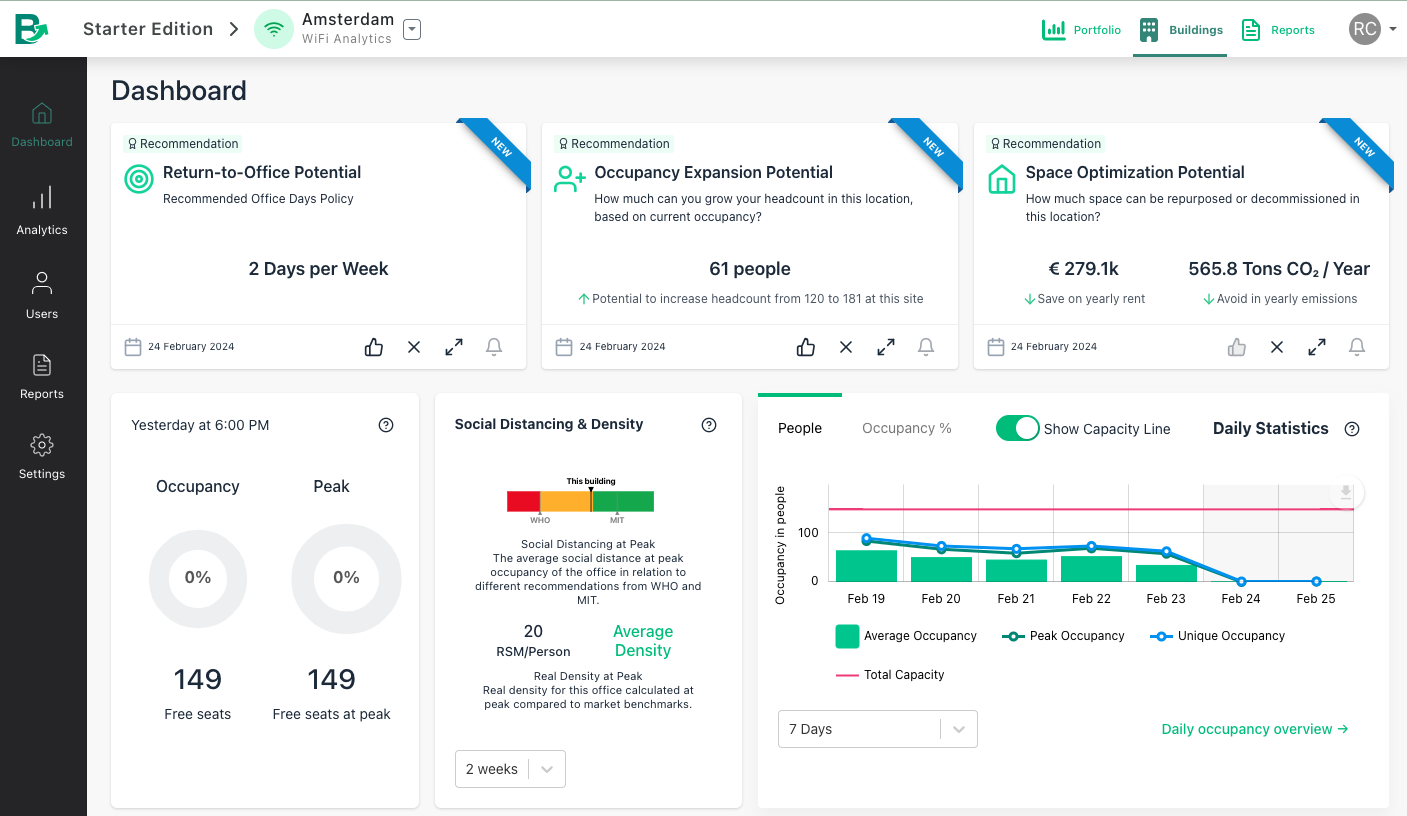

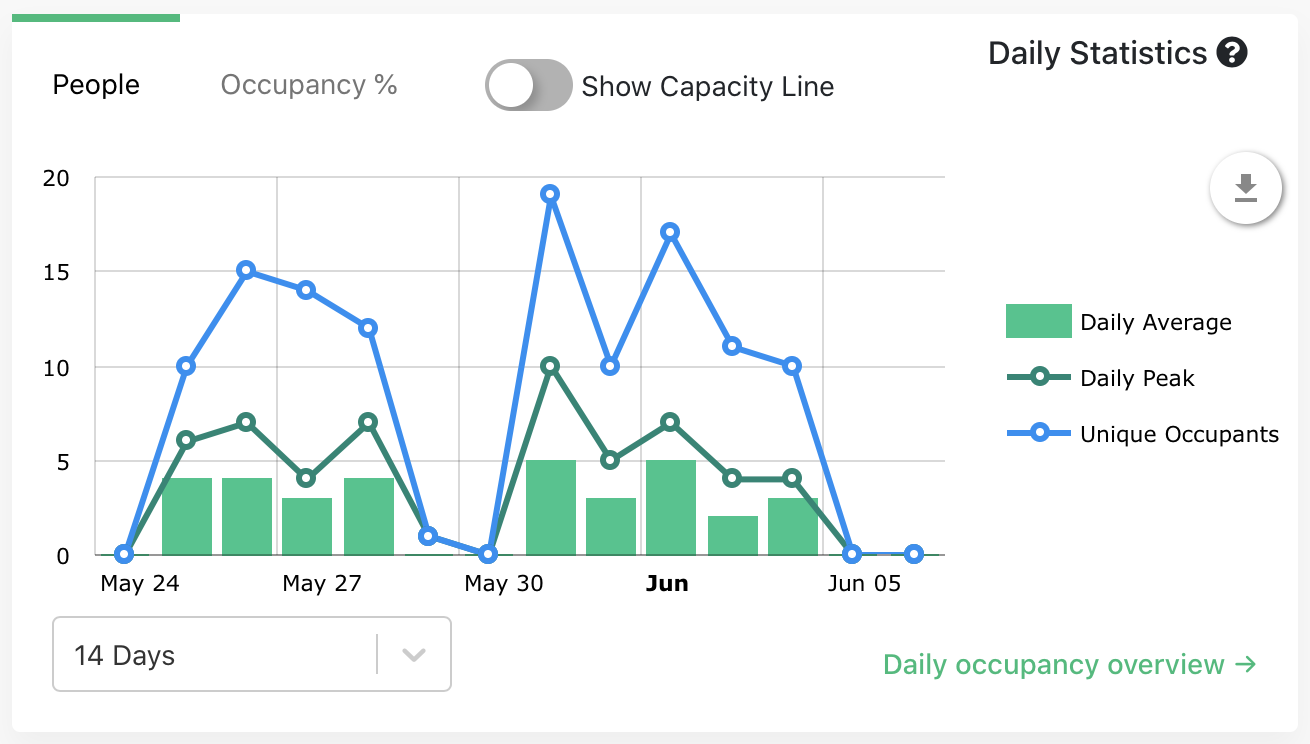

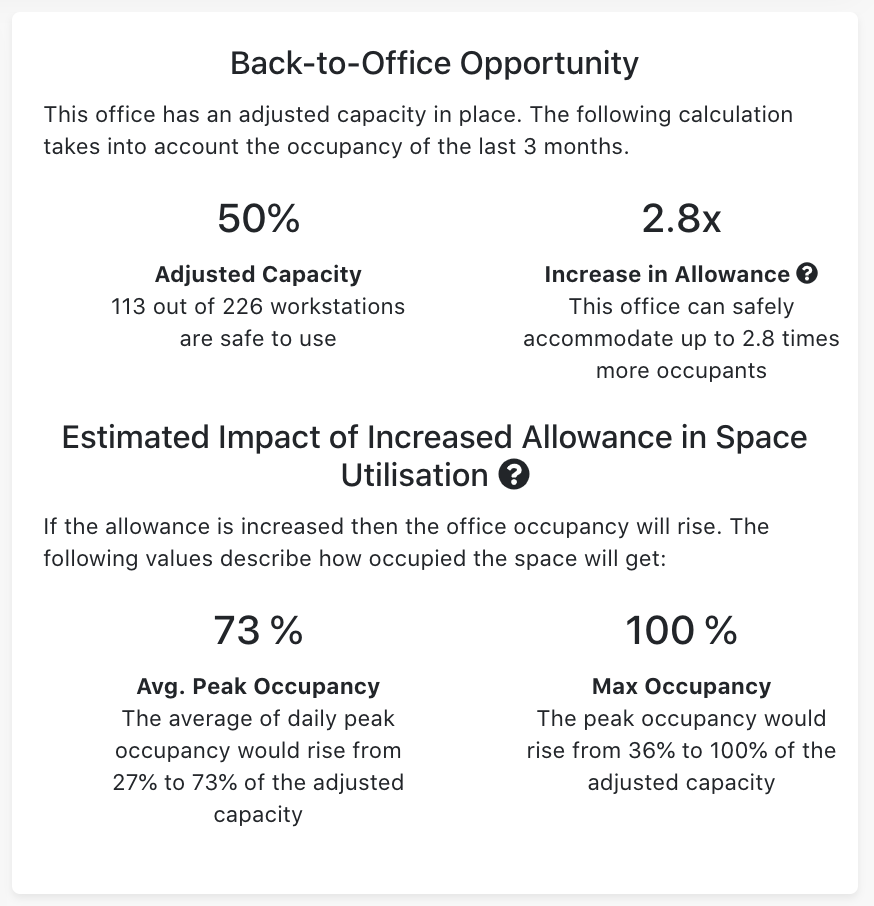

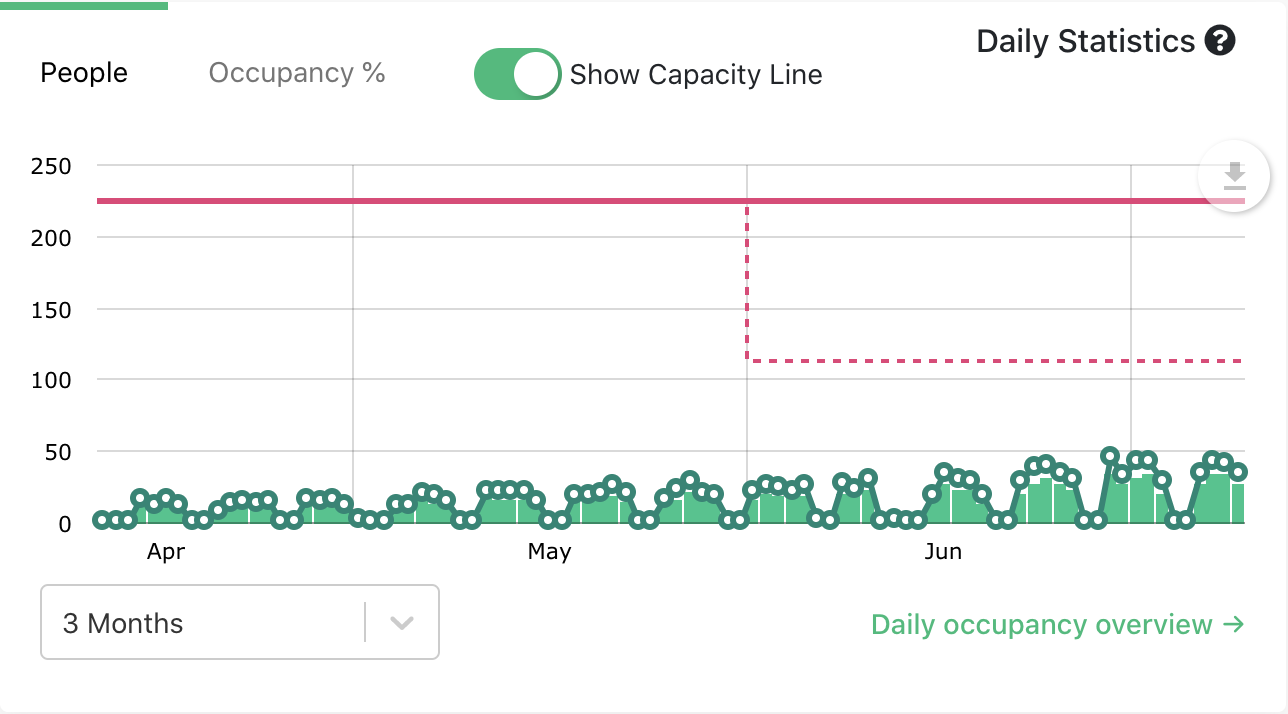

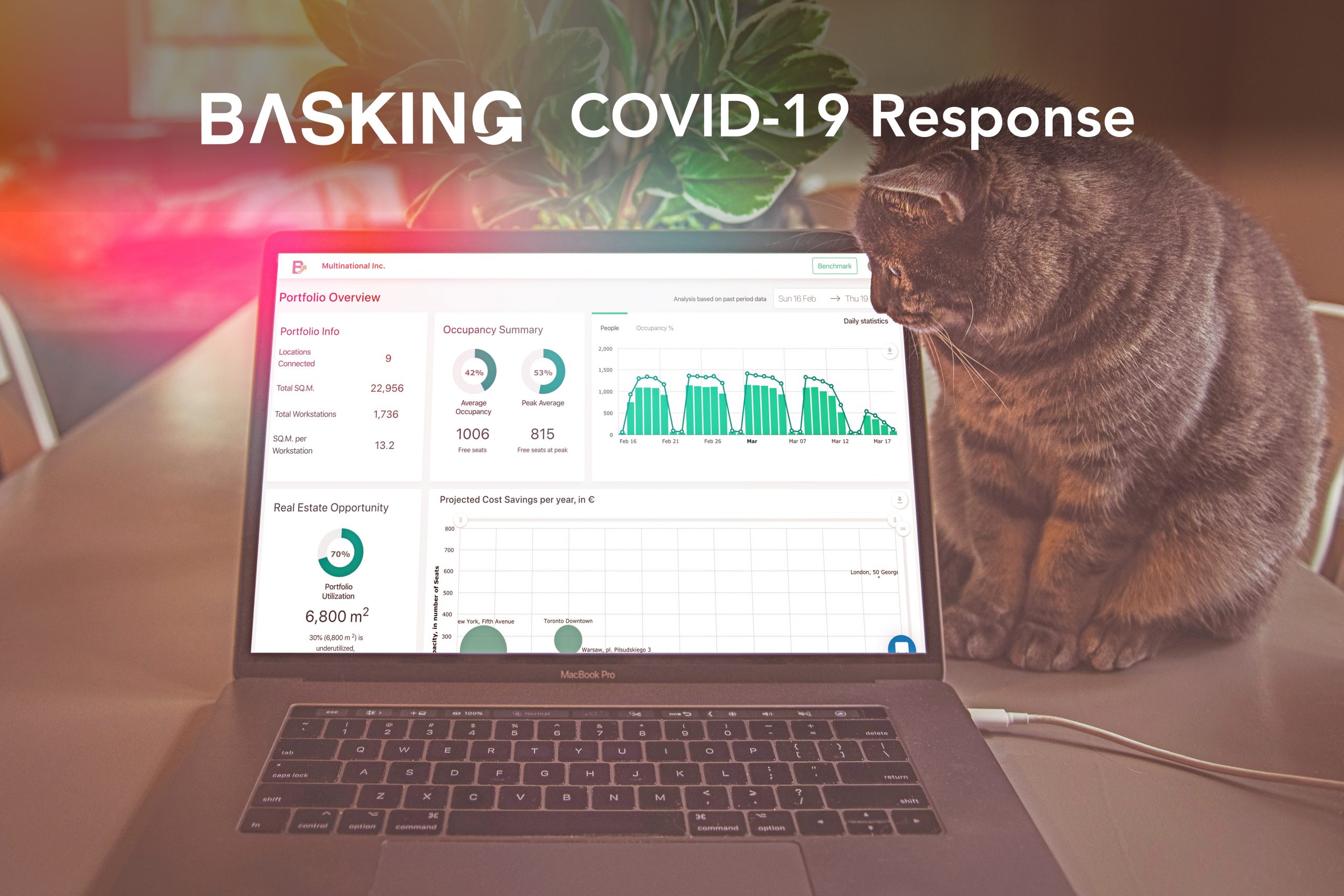

Basking provides a web app and simple API for companies to deploy its office occupancy analytics solution in as little as two hours, enabling real-time data analytics for workplace management and flexible workplace adoption.

Berlin, Germany, August 12, 2021 – Basking.io, a workplace occupancy analytics provider, today announced additional investment from notable proptech investors — Blue Field Capital, led by Zain Jaffer, Aconterra and Ray Wirta, a board member and former Chairman and CEO of CBRE Group. The financing will support further market expansion and enable Basking to enhance the platform for partner app developers.

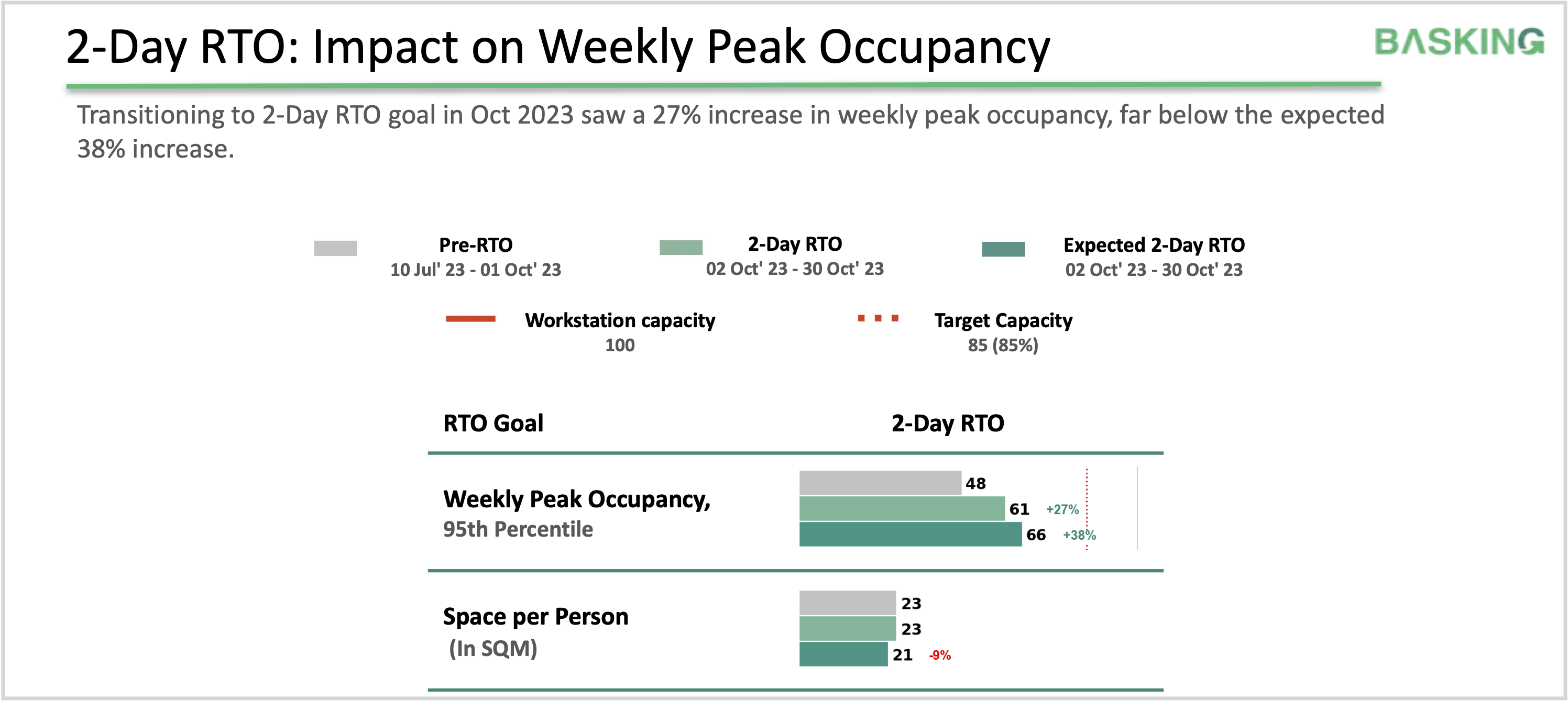

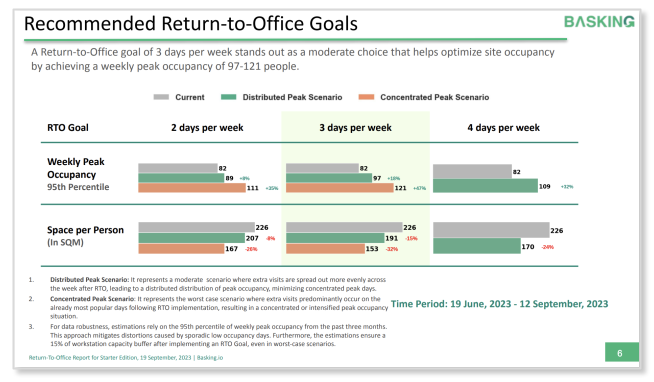

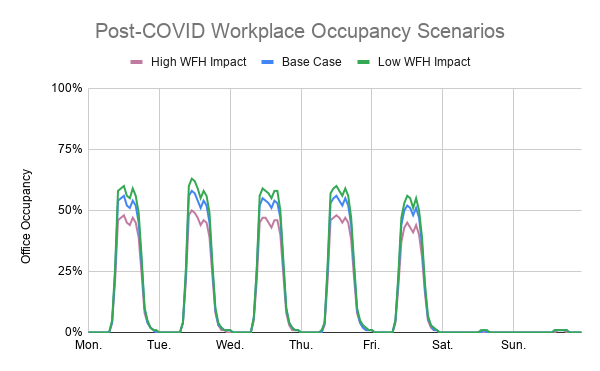

According to industry analysts from Memoori, the market for AI solutions in smart commercial buildings will grow by 24.3% CAGR through to 2025 nearly tripling in value to approx. $3.3 billion by 2025. Occupancy analytics is identified as one of the key application-specific areas in the market, as these solutions can inform critical decisions around how staff can return to offices and avoid unexpected overcrowding.

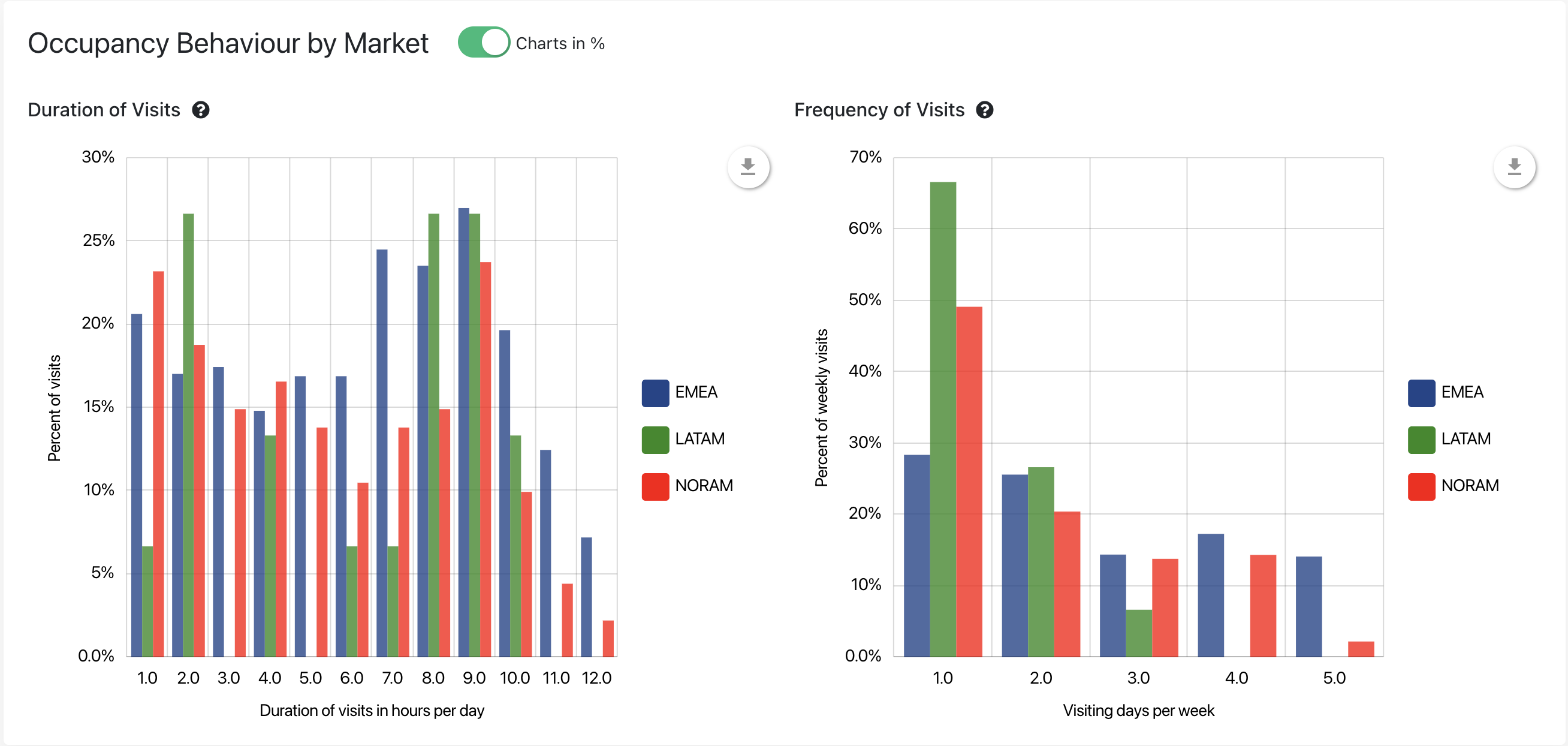

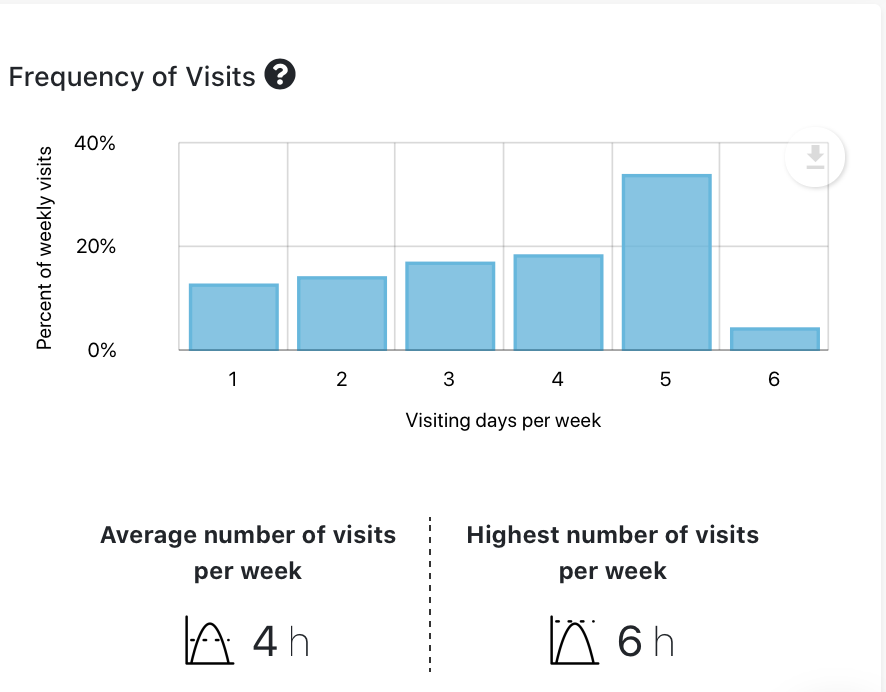

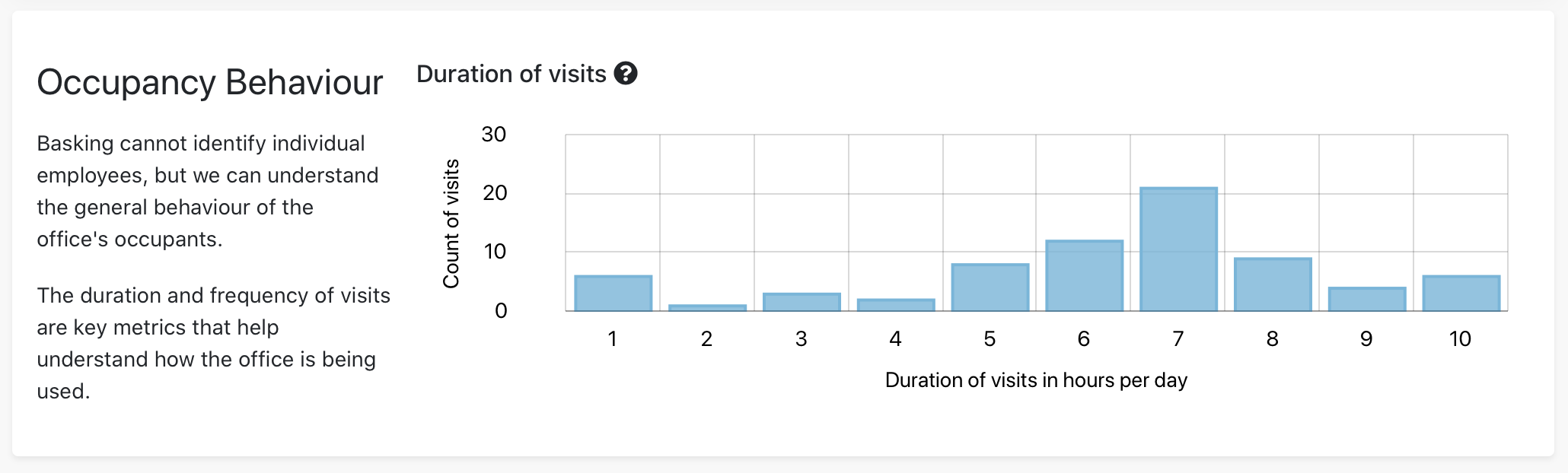

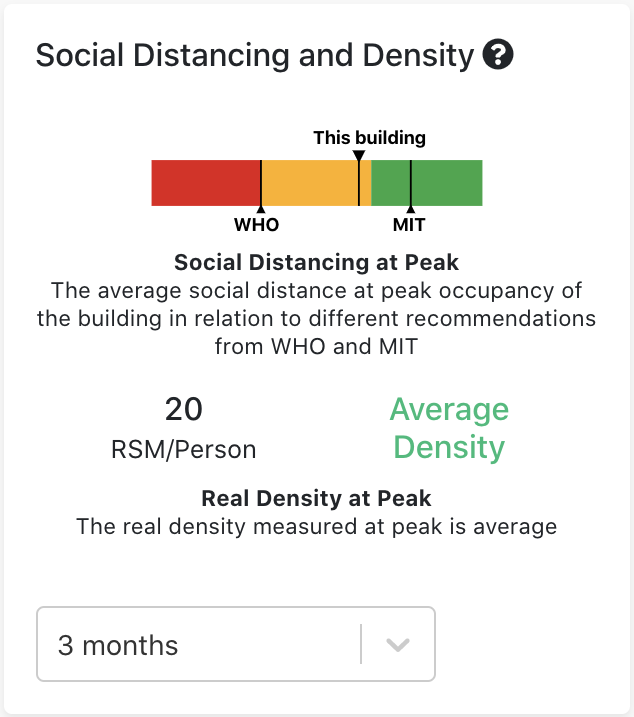

Basking provides a wide range of workplace occupancy analytics through its web application, API and SDK, which gives companies the ability to easily integrate its reports into any application or data lake of their choice. To provide these insights, Basking uses existing infrastructure like WiFi networks and video conferencing equipment as data sources and complements them with additional sensors from selected partners. With Basking’s infrastructure-as-a-sensor platform, companies can access and scale occupancy analytics at low costs, while ensuring compliance with GDPR regulations.

“With the rapid adoption of the work-from-home and work-from-anywhere culture, occupiers are actively looking to use less, but better, space and use it more flexibly. Basking’s solution provides a way to quickly leverage the data available and get the insights required to inform the corporate real estate and workplace strategy,” said Eldar Gizzatov, CEO and cofounder of Basking. “Occupancy analytics and forecasting are key to solving both the short-term challenge of implementing back-to-office measures, and the long-term challenge of meeting employee demand for flexibility and adapting the footprint to new requirements.”

“This year is transformative for many companies as they transition to permanently remote or hybrid models. To enable this shift, most market incumbents – from landlords to advisors – are seeking data-based solutions for ongoing management of workspace demand and supply,” said Zain Jaffer, Partner at Blue Field Capital. “We invest in trailblazers who are not just innovating their industries but disrupting them completely. Data-driven office space demand management is the future of work, and Basking is carving out an entirely new category with its infrastructure-based platform and public API approach.”

“We’re witnessing a major transformation of the way office buildings are used and operated,” said Ron Schuermans, Founding Partner at Aconterra. “Some of the leading companies at the forefront of this change have already recognized the potential of Basking’s workplace management platform and are using it across their portfolios. That’s why we’re excited to invest in Basking – it allows the executives to plan ahead and stay informed of the changes in real-time.”

“Flexible work is here to stay and existing solutions for occupancy management are failing to meet the needs of occupiers,” said Ray Wirta. “I’m excited by Basking’s ability to quickly provide the workplace insights at scale and help real estate managers to stand out at their jobs.”

About Basking.io (Basking Automation):

Basking.io is a workplace occupancy analytics platform, providing corporate real estate teams with real-time monitoring tools, workplace management analytics, and portfolio optimization insights. The platform is used by Fortune 500 companies and landlords across North America, LATAM, EMEA and APAC. Basking’s partners include Colliers International, Cisco DNA Spaces, HPE Aruba, and Comfy, a Siemens company.

Basking previously raised 1.4 million dollars from Future Energy Ventures, E.ON’s venture capital investment and collaboration platform, in an initial seed investment round. The company also participated in Colliers Techstars Proptech Accelerator, the Toronto-based accelerator program for property and real estate startups run by Colliers and Techstars, in 2018. Basking was nominated for the Property Awards 2020 in the Proptech Innovation of the Year category and won the German Property Association (ZIA) Office Awards 2019.

About Blue Field Capital:

Blue Field Capital is a private equity real estate firm with multifamily, hospitality and senior housing real estate holdings, as well as a VC fund that invests in real estate-related (PropTech) opportunities.

About Aconterra:

Aconterra is a focused ‘Smart Building Technology’ venture capital fund. It finances and supports European early stage companies that make buildings more intelligent and energy efficient, safer and better to live or work in. As an open ended ‘evergreen’ fund, Aconterra aims for long term value and impact while creating an ecosystem for its investors and portfolio companies. Aconterra is based in Antwerp, Belgium – www.aconterra.com