Global Occupancy Benchmarking Report Q2 2022: Return to Office So Far

Has the Return-to-Office improved since Q1 2022? To find out, our team at Basking.io followed up on the report describing the occupancy trends in Q1 2022. Once again, Basking.io looked at aggregated data from 100 offices (7 organizations, primarily in professional services and technology sectors) across the world with 39% of offices located in EMEA, 40% in North America, 10% in LATAM, and 11% in the APAC region.

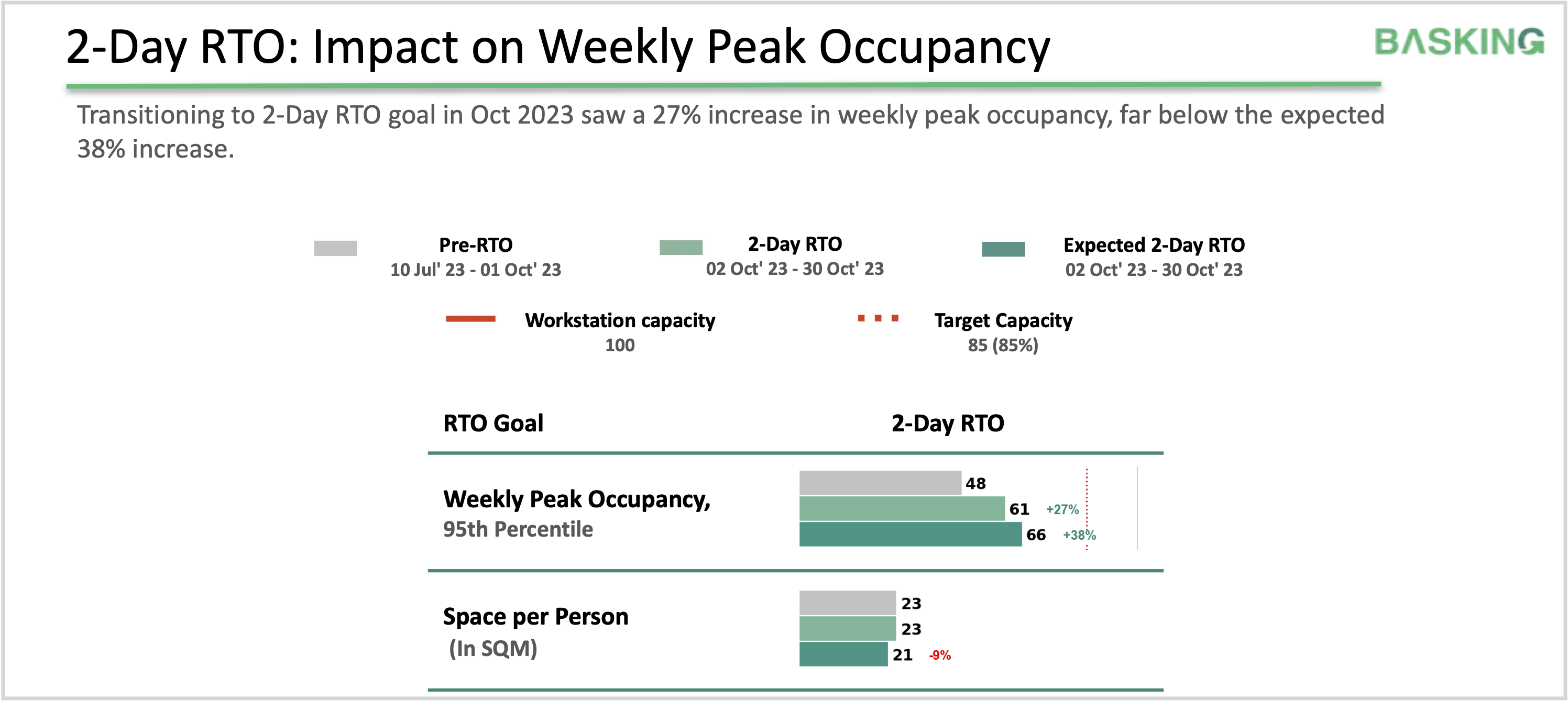

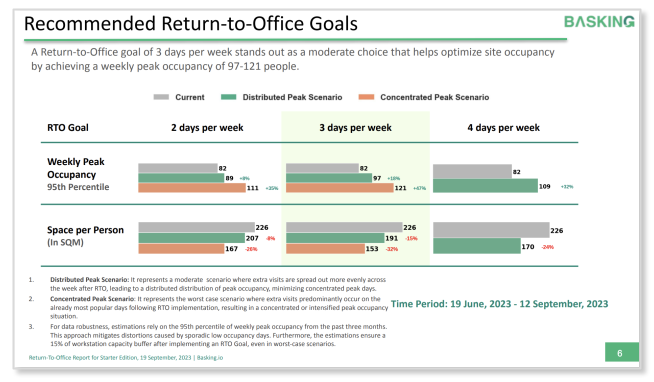

The shift in occupancy trends from Q1 2022 to Q2 2022 underscores the speed of hybrid work adoption by companies across the globe. These dramatic changes in the workplace environment are driven by both employees’ demands and companies adjusting their expectations accordingly.

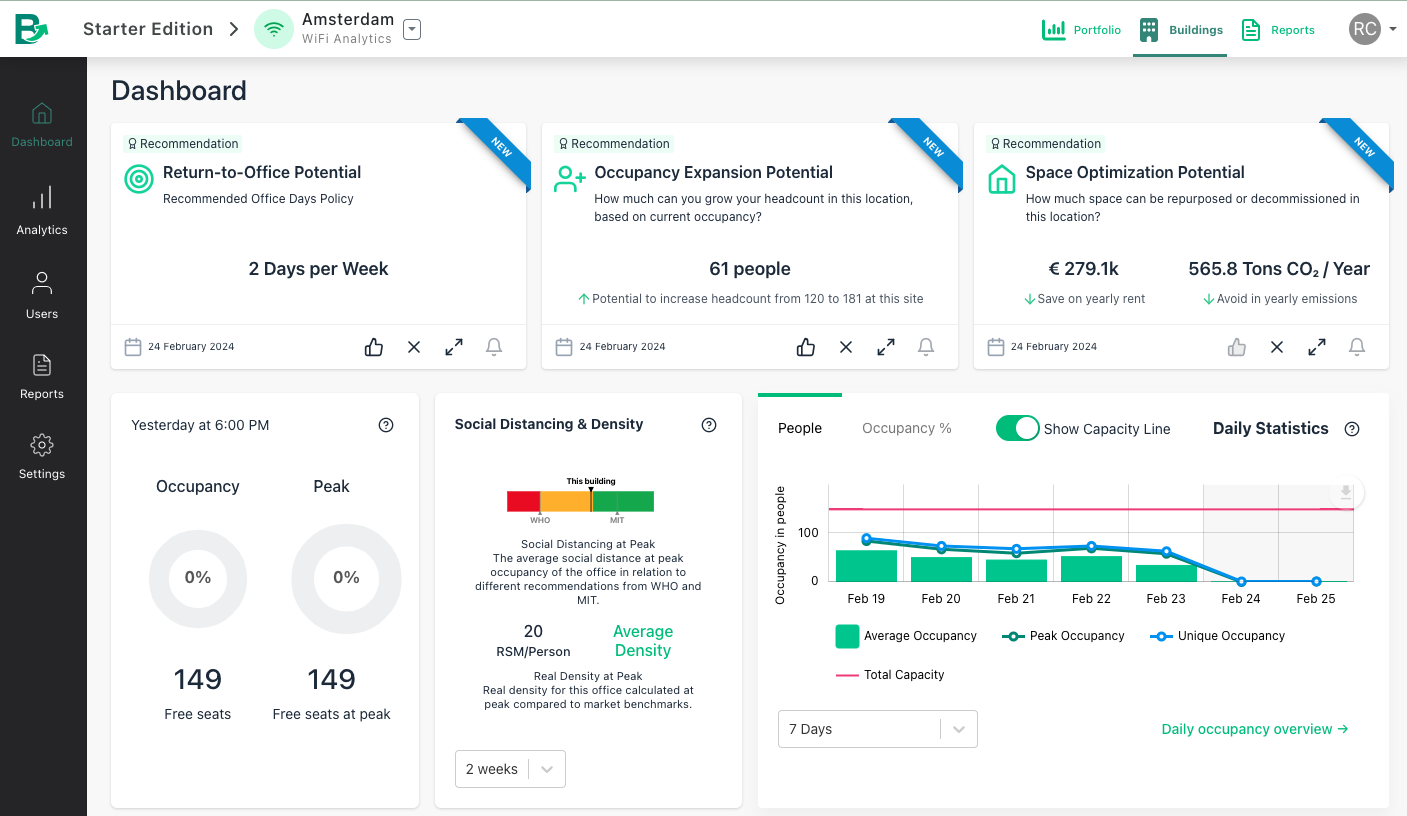

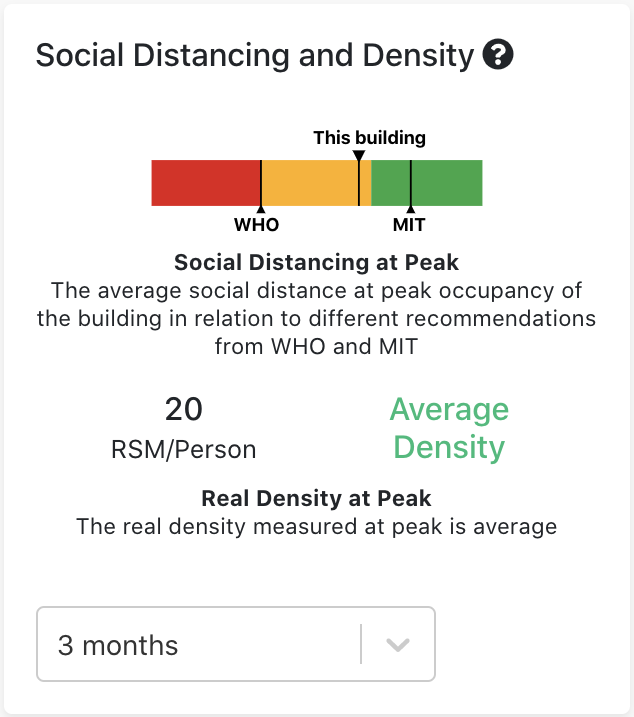

With the implementation of hybrid work policies, it is crucial for the companies worldwide to monitor their office space usage which can support their portfolio optimization strategies.

KEY FINDINGS

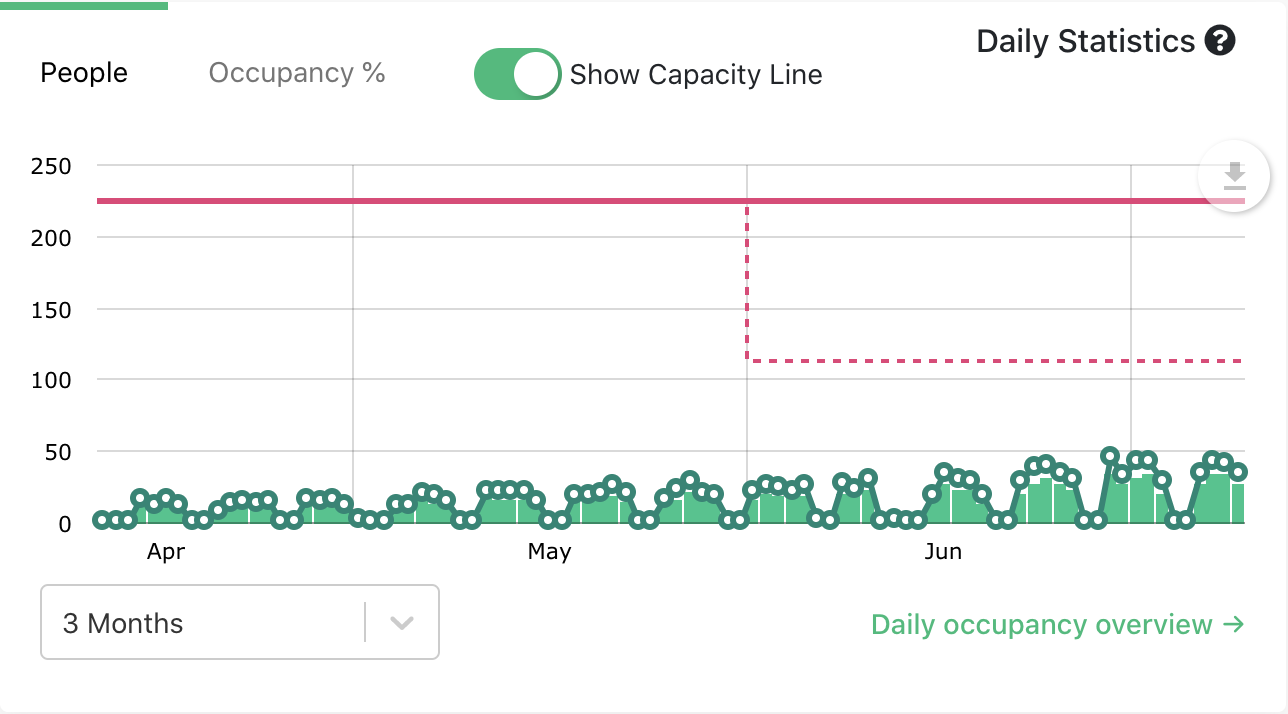

- Globally, the average peak occupancy rate was lower than 40% in Q2 2022, too.

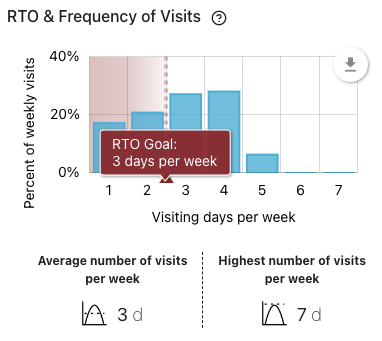

- Globally, the percentage of visits for the “Once a week” category increased by 14% on average in Q2 2022 over Q1 2022 and “6-8” hour duration visits increased by 7% on average in Q2 2022. This indicates that most people prefer visiting the office once a week but for longer durations.

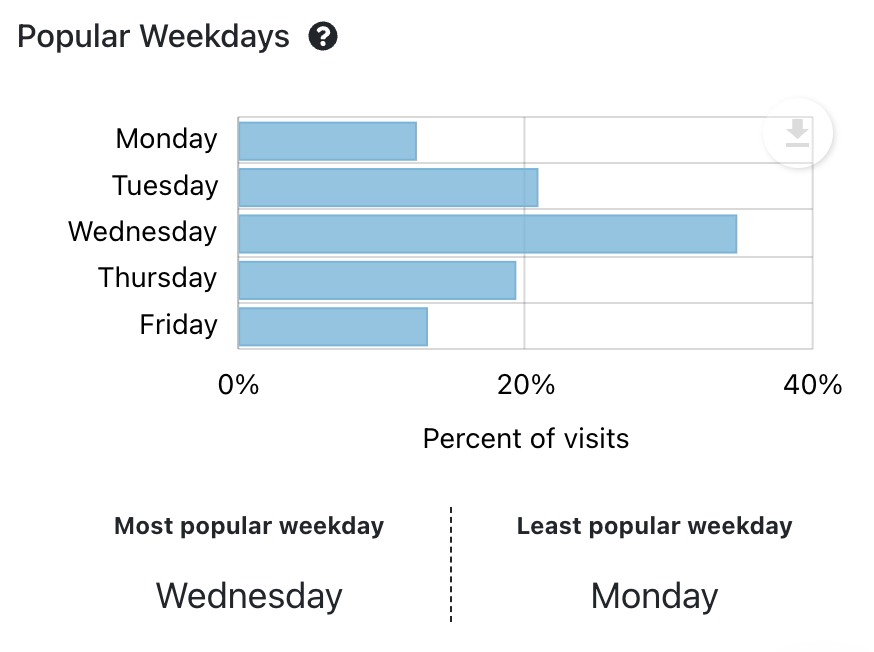

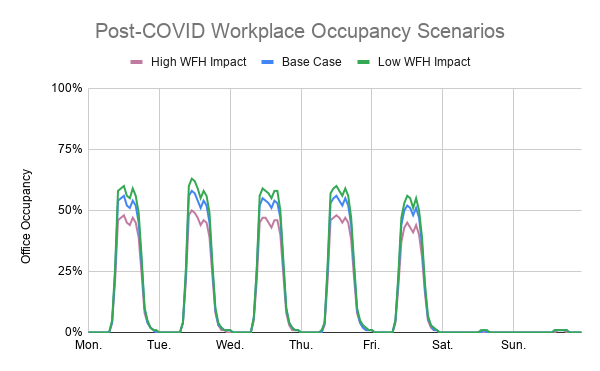

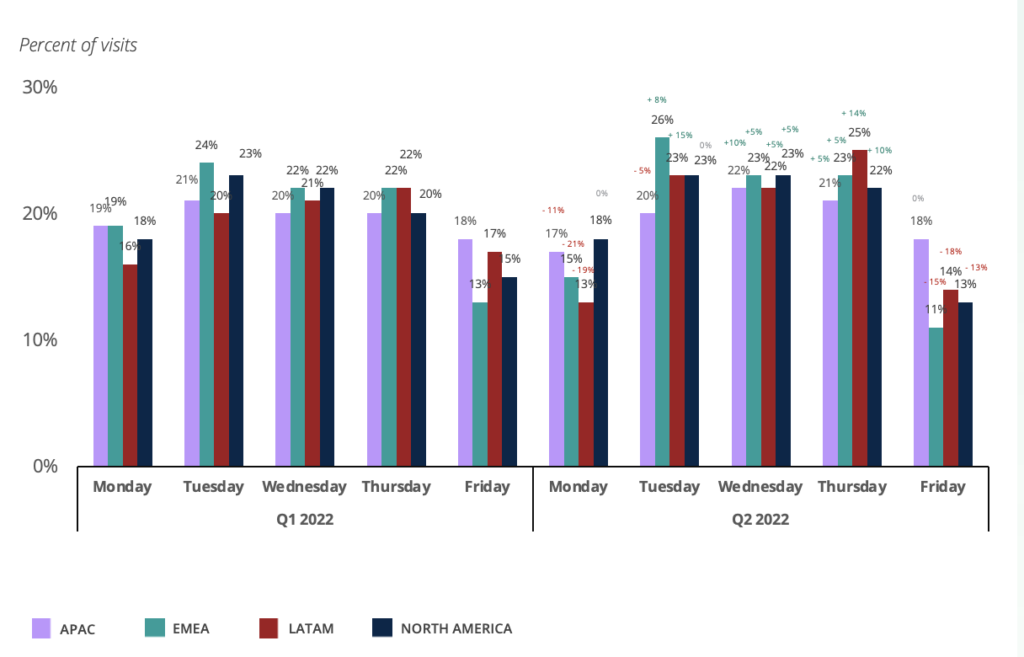

- Midweek is still most preferred by employees across the globe for office visits, making Mondays and Fridays the least popular days.

- Similar to Q1 (17%), Mega cities observed the lowest average peak occupancy rate in Q2 2022 (18%) indicating that commute time is one of the biggest hurdles for the companies to get people back in the offices.

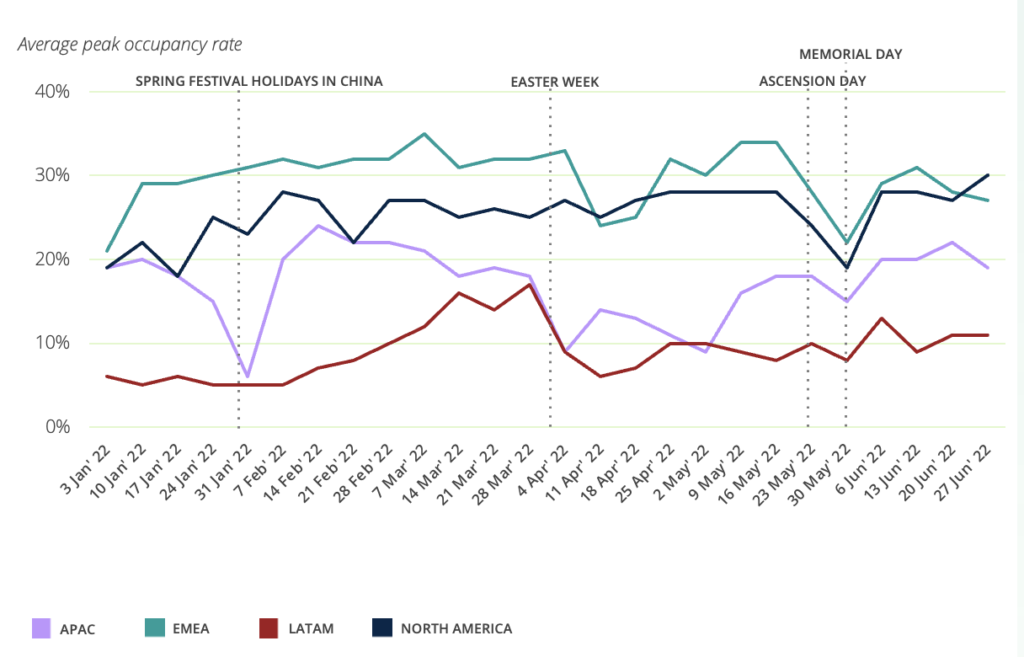

GLOBAL AVERAGE PEAK OCCUPANCY RATE STAYED BELOW 40% in Q2 2022

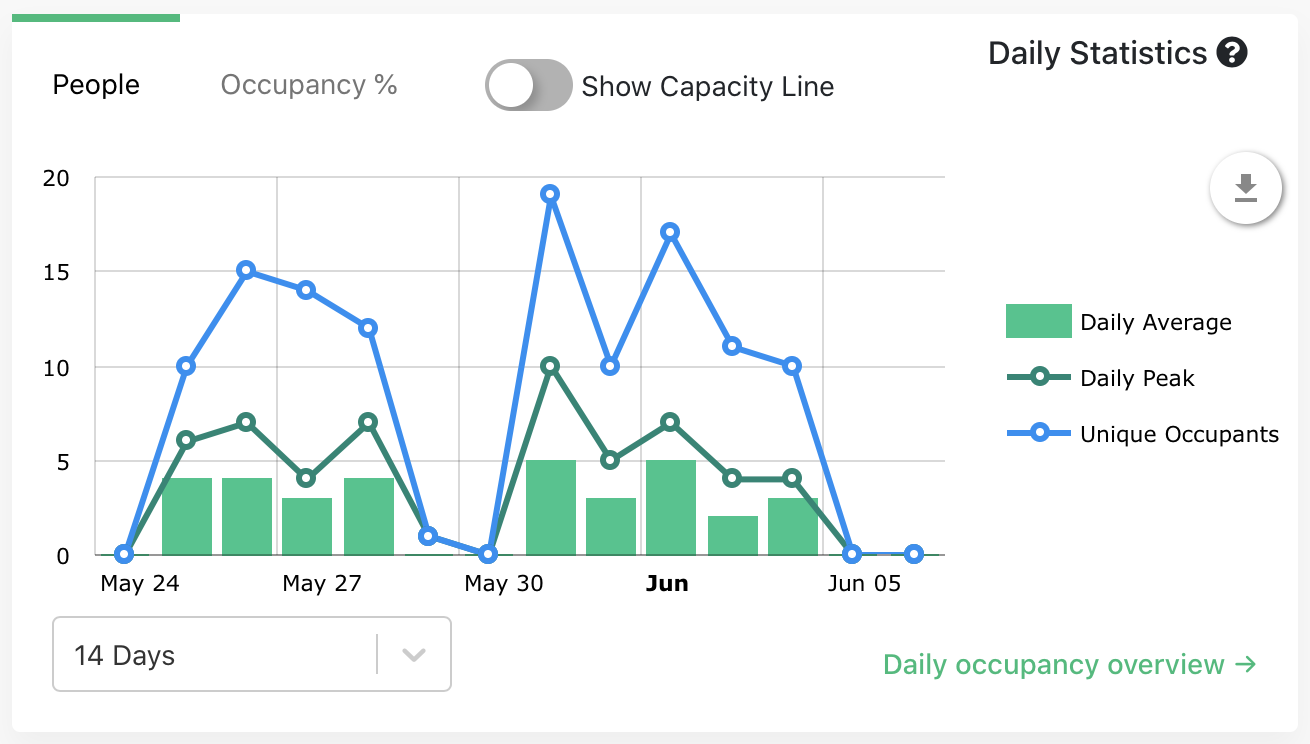

The average peak occupancy rate in Q2 2022 was highest in EMEA (Q1: 31%, Q2: 29%), followed by North America (Q1: 24%, Q2: 27%), APAC (Q1: 18%, Q2: 16%) and LATAM (Q1: 9%, Q2: 9%).

The average peak occupancy rate in LATAM offices peaked during the last week of March (16%) and then dropped to 11% during the last week of June.

The average peak occupancy rate for EMEA dropped during the last two weeks of May due to Ascension day and additional bank holidays in the UK (2nd, 3rd June 2022).

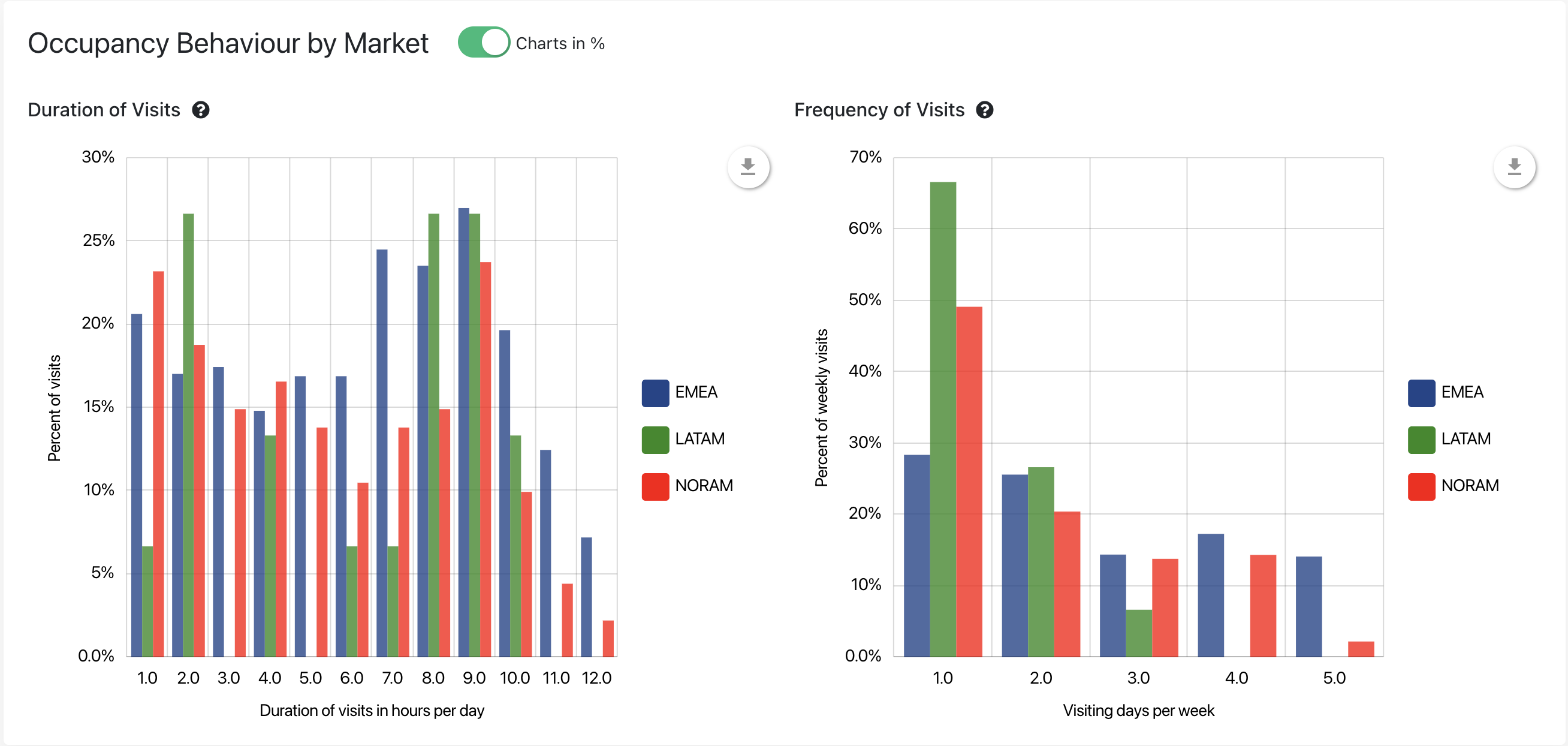

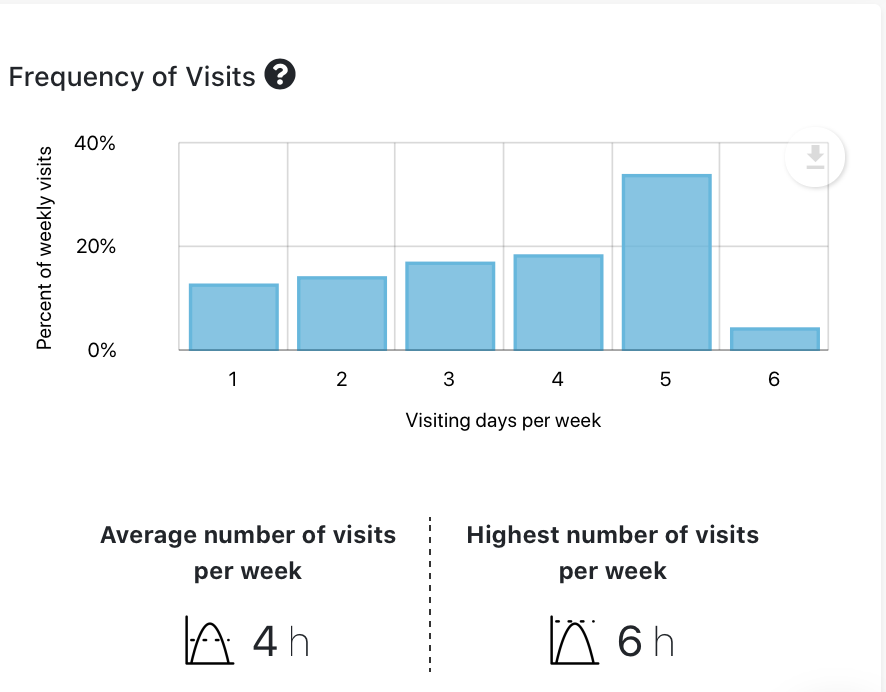

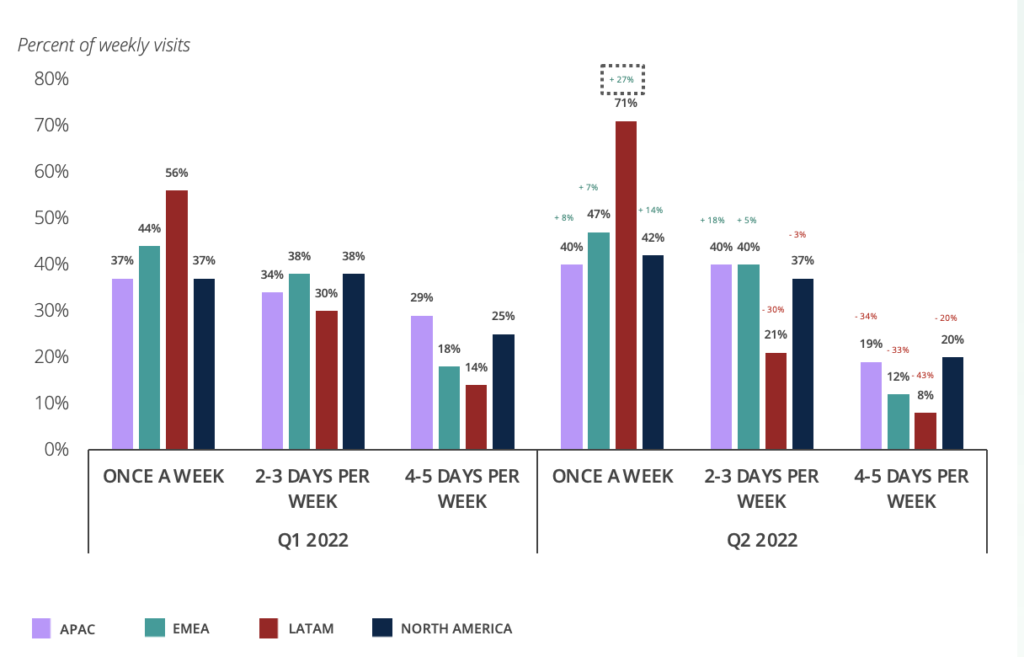

GLOBALLY, “ONCE A WEEK” VISITS INCREASED BY 14% QOQ

On average, globally, the “Once a week” category increased by 14% in Q2 2022 with LATAM increasing its share by 27%.

The 33% decline (on average) in the “4-5 days per week” category during Q2 2022 corresponds to an increase in the “Once a week” category.

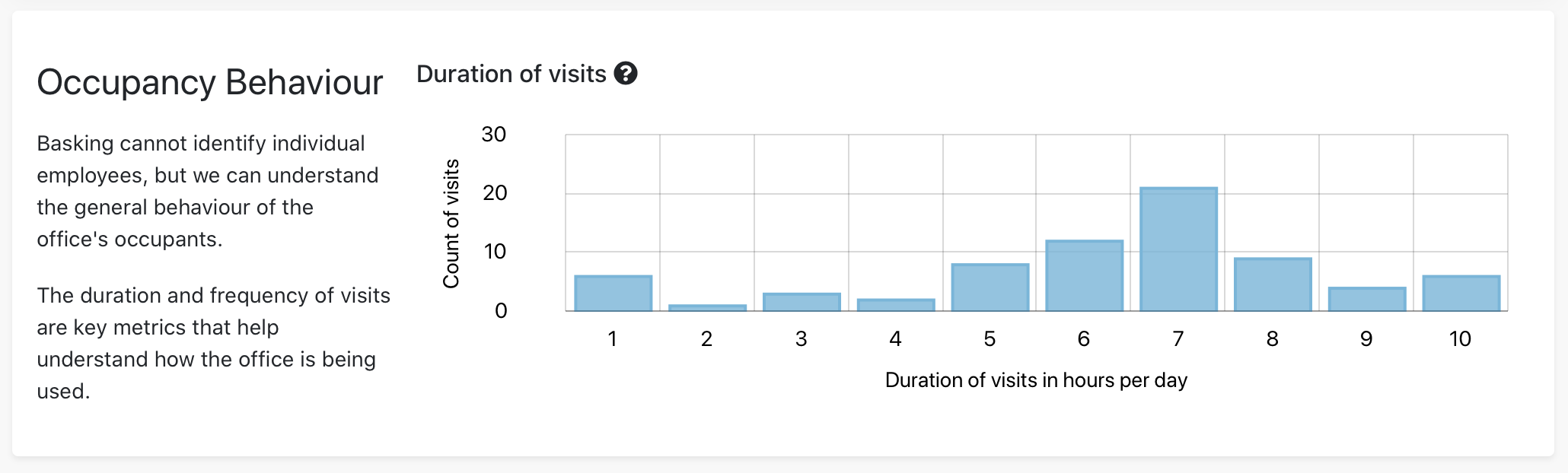

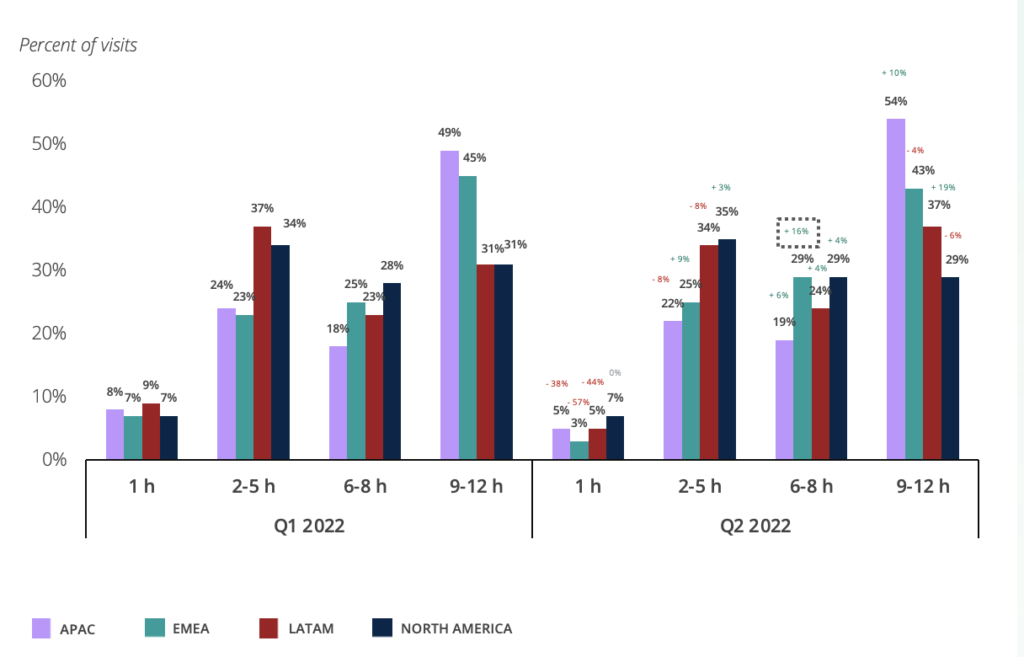

GLOBALLY, “6-8” HOUR DURATION VISITS INCREASED BY 7% QOQ

In Q2 2022, “1” hour visits observed a sharp decline (35%, on average), globally.

”6-8” hour duration visits increased across all regions with an average of 7%. EMEA offices (16%) reported the highest increase in this category for Q2 2022.

MIDWEEK VISITS INCREASED BY 6% QOQ

On average, the percent of visits decreased for Mondays and Fridays by 13% and 12%, respectively.

In Q2 2022, the highest percent of visits during midweek were observed for EMEA (Q1: 68%, Q2: 72%), followed by, LATAM (Q1: 63%, Q2: 70%), North America (Q1: 65%, Q2: 68%) and APAC (Q1: 61%, Q2:63%).

You can find the report in full here. If you have any feedback or ideas on what we should look into next, reach out to us on Linkedin, Twitter, or email benchmark@basking.io directly. Get in touch if you have any questions!