The Time is Now: Unlocking the Sustainability Potential in Your Portfolio

As the first Paris Agreement Global Stocktake looms large, assessing collective progress toward the 1.5º C ceiling on planetary warming, there is strong momentum to do what it takes to reduce greenhouse gas emissions. Representing almost 40% of global CO2 emissions, the real estate sector has the opportunity to lead the charge in driving sustainability.

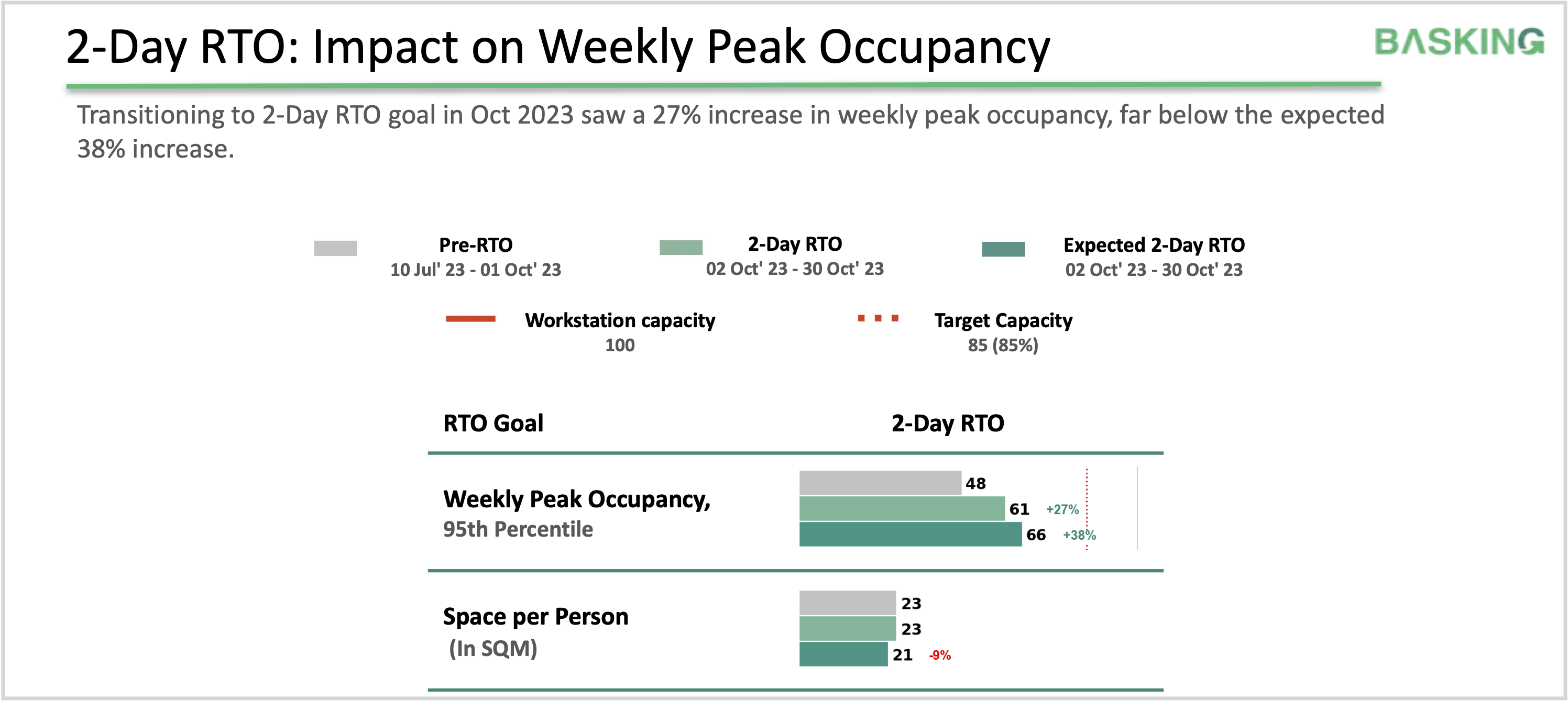

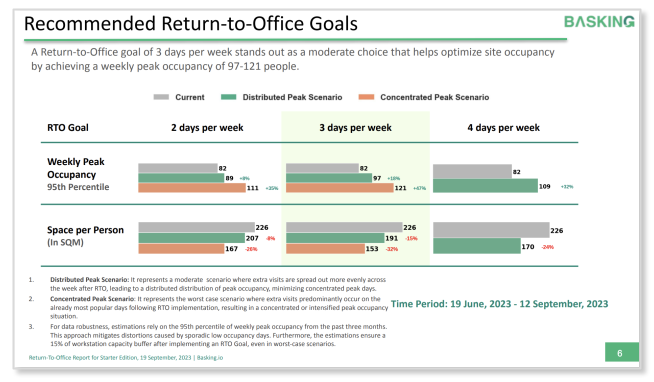

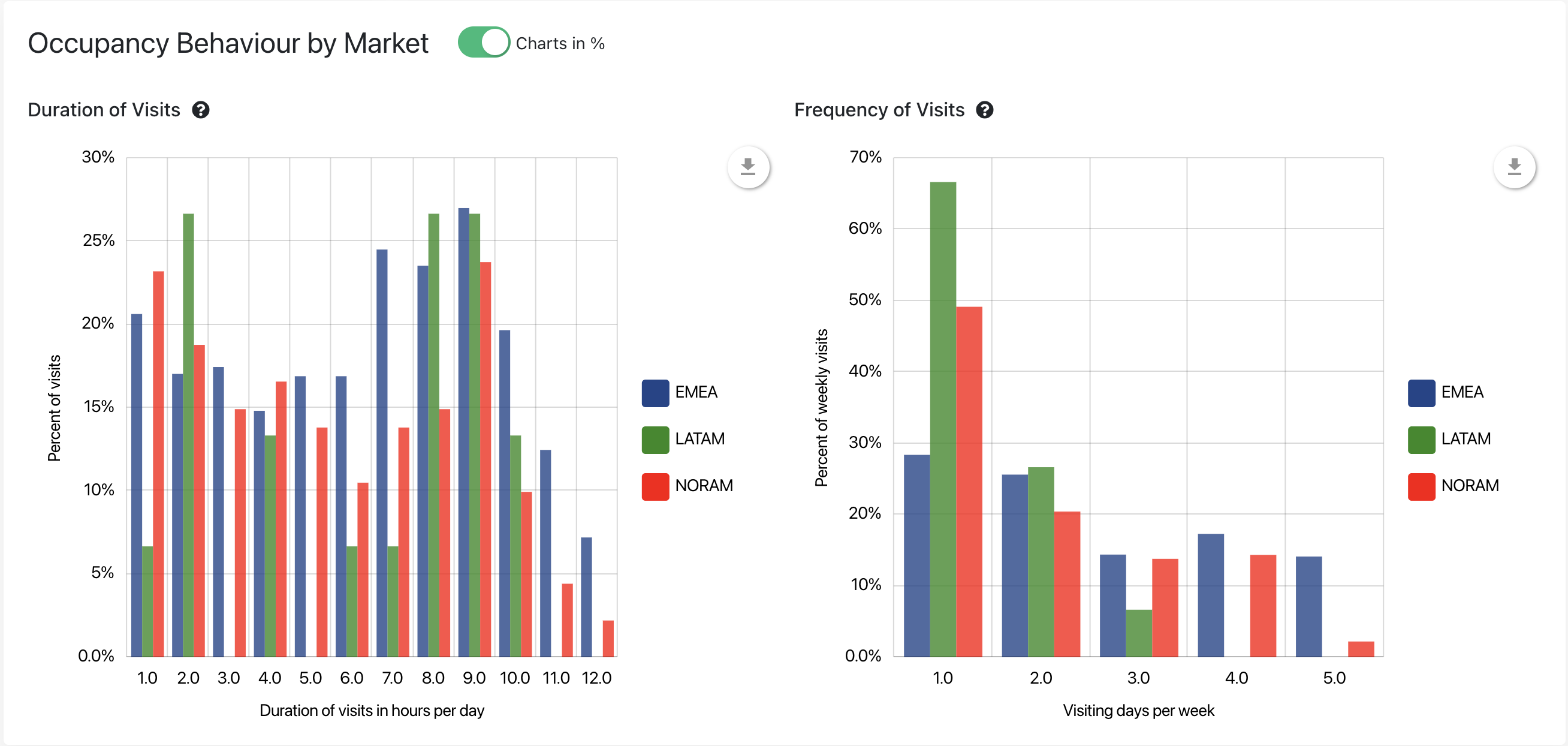

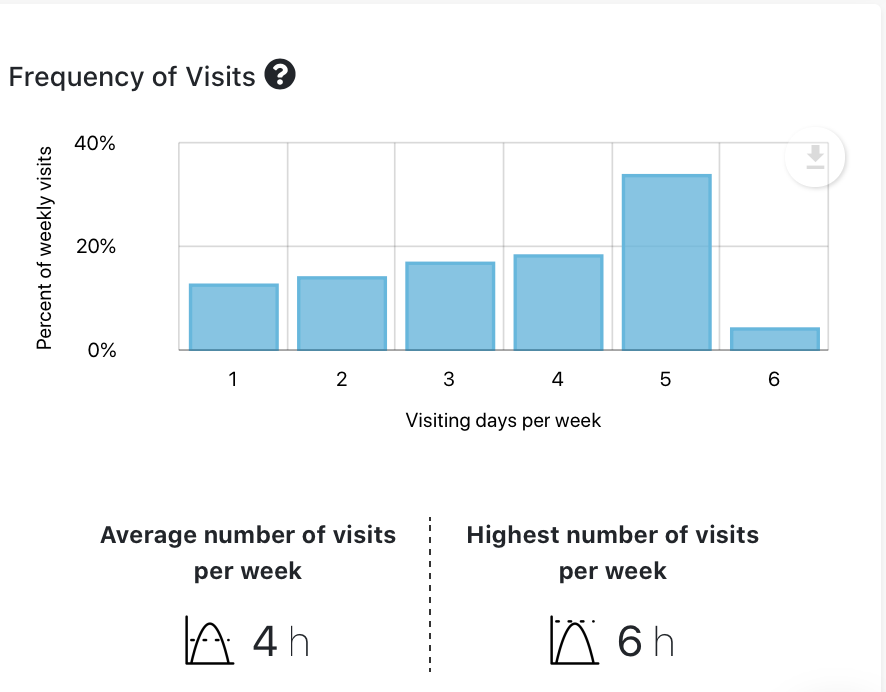

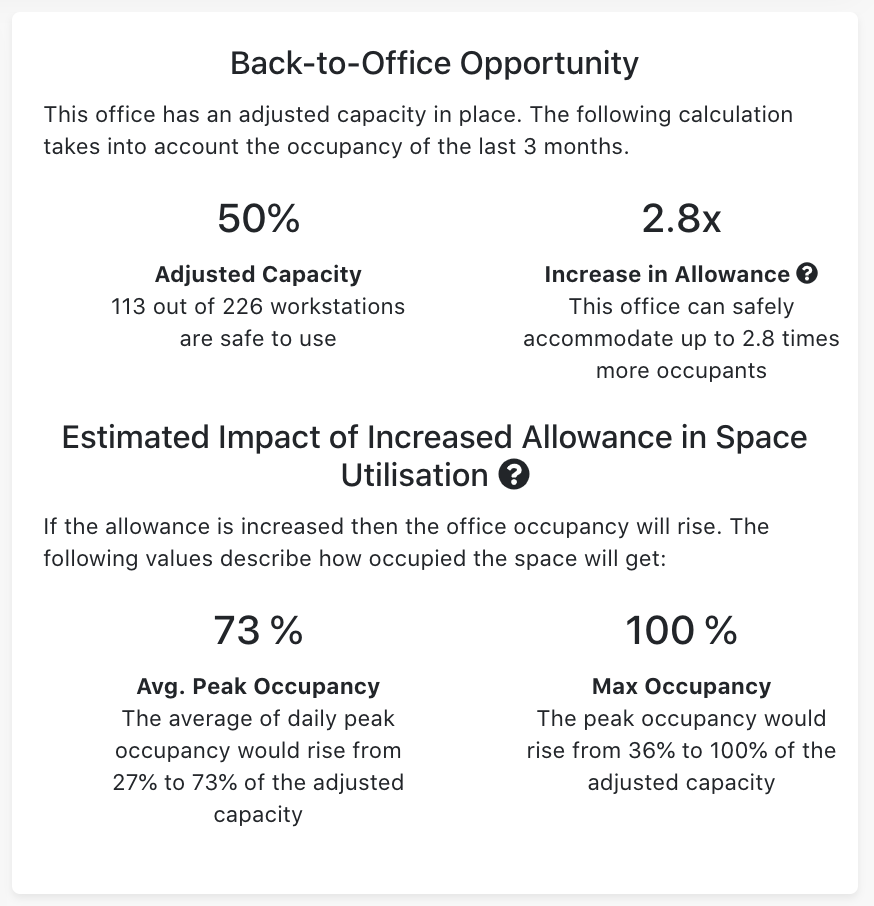

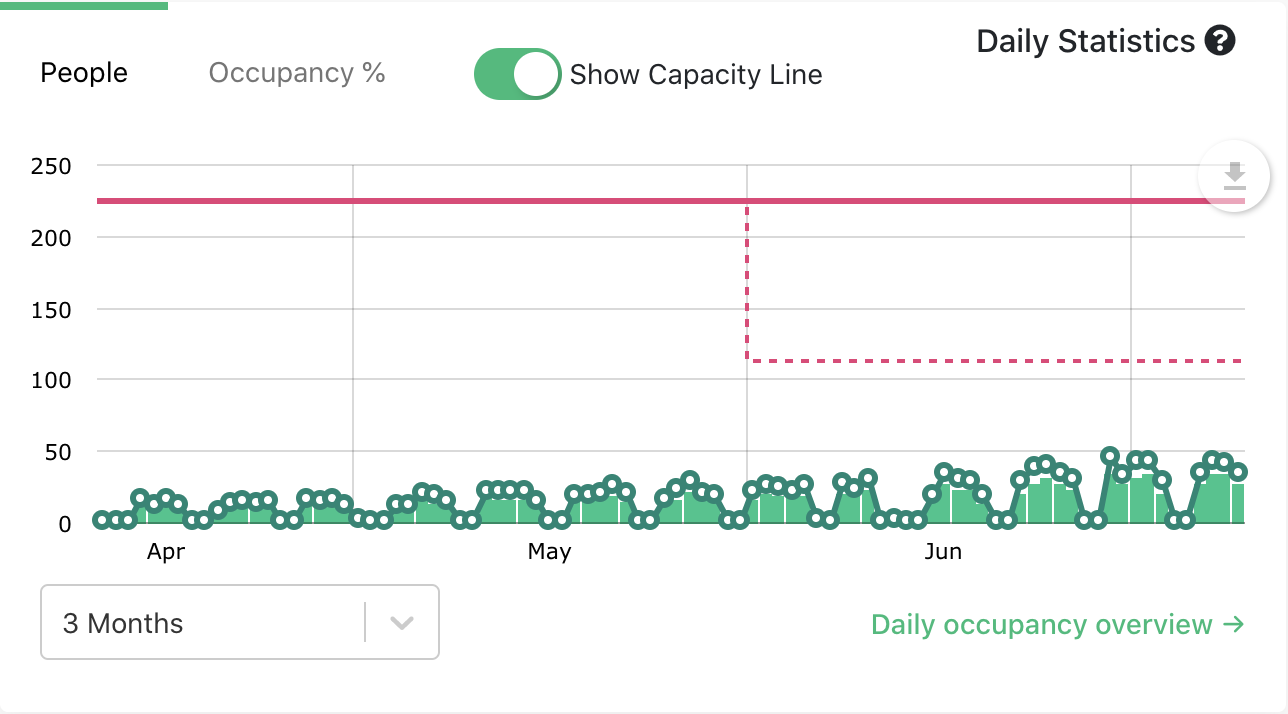

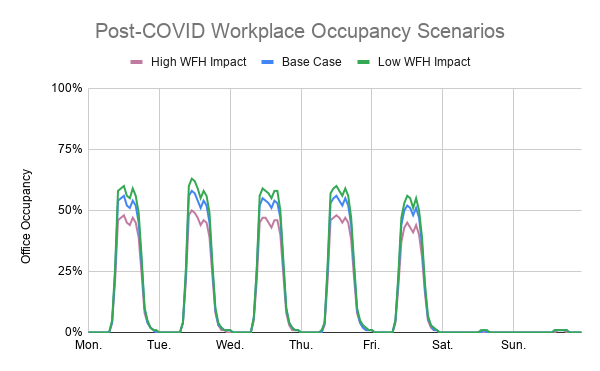

Embracing sustainability as an opportunity rather than a matter of compliance creates the potential to add value beyond status quo, placing environmental, social, and governance issues within the larger context of increasing social expectations and corporate accountability. This opportunity intersects with the ongoing reassessment of occupancy and utilization in the post-COVID19 era, with occupancy no longer a constant and flexibility dominating workplaces and spaces.

Sustainability From the Start

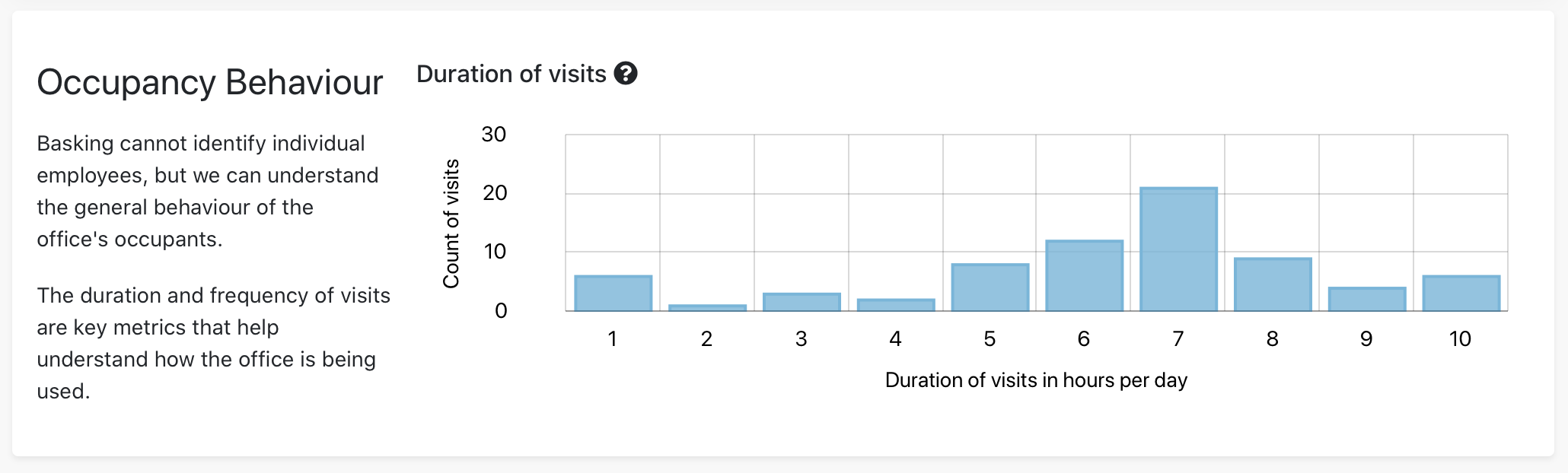

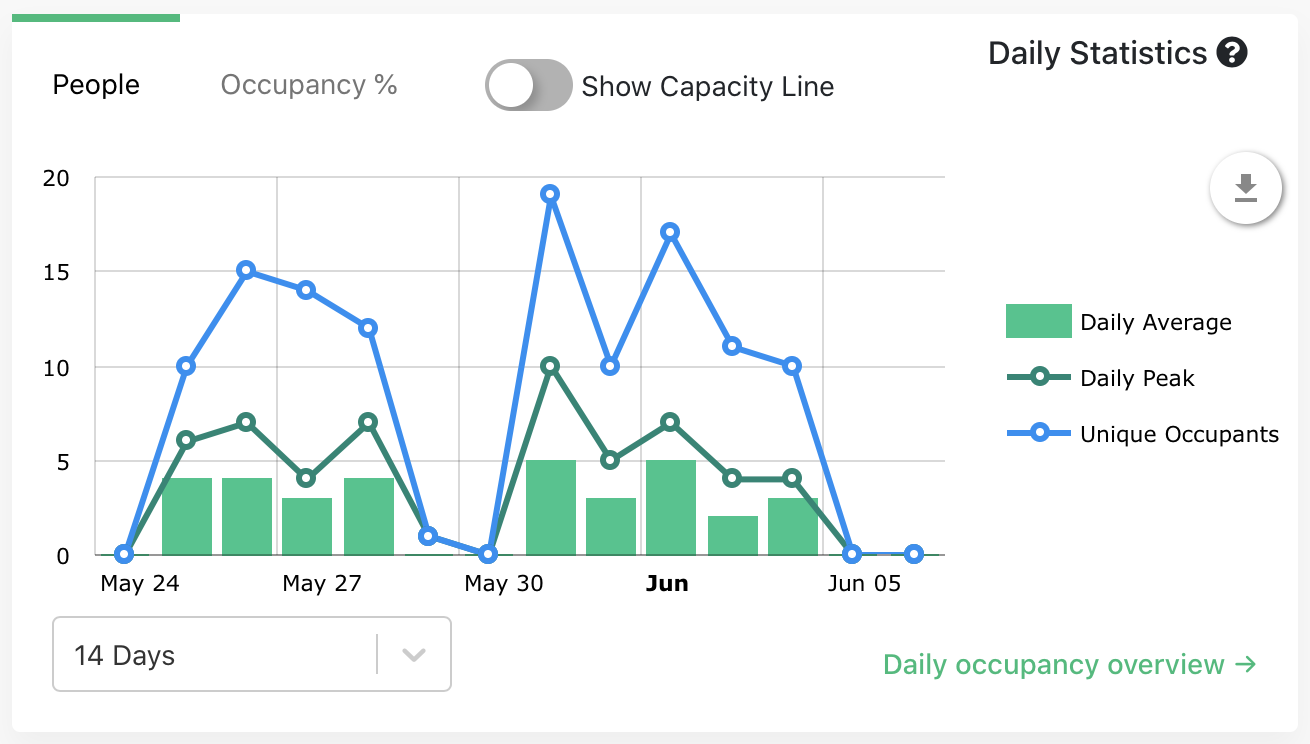

Environmental protection and sustainability are the core values of the Basking founders, and the reason why Basking was created. To manage impact, organizations must be able to measure their impact—which requires an accurate, dynamic picture of their utilization in real-time in an accessible format to surface actionable insights.

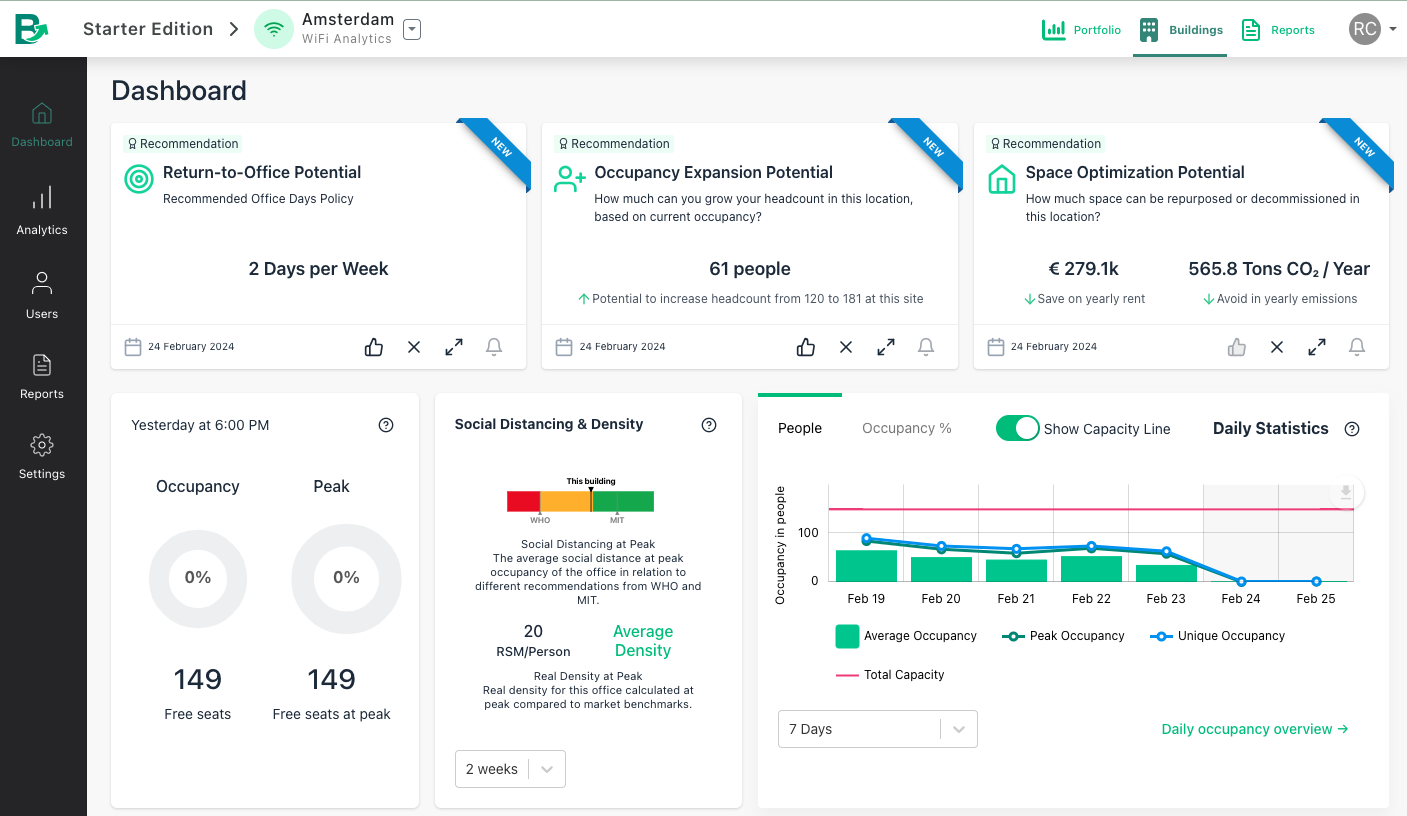

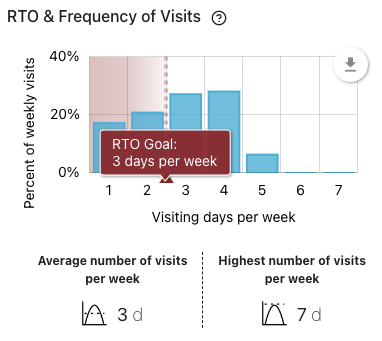

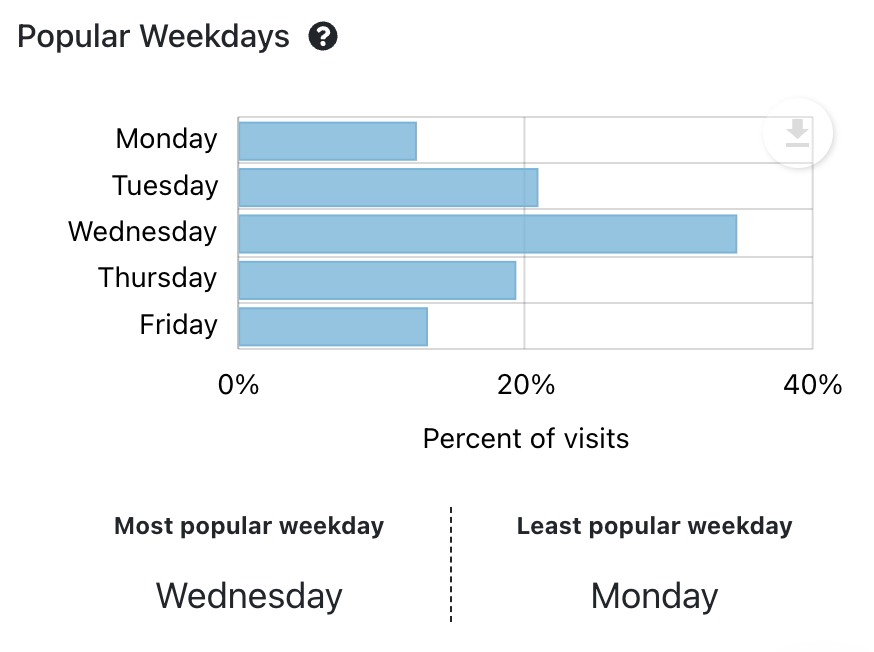

The Basking dashboard does just that, with in-app reporting ranging from Portfolio Management for optimization potential to Business Unit Space Analysis. With 28% of the industry’s carbon footprint resulting from building operations, this depth of understanding can unlock new opportunities for real estate management to maximize distribution across their portfolio. For some that may look like distribution incentives or replacing fixed workstations with flexible workspaces, for others portfolio consolidation can represent significant financial and environmental savings.

Driving the Conversation

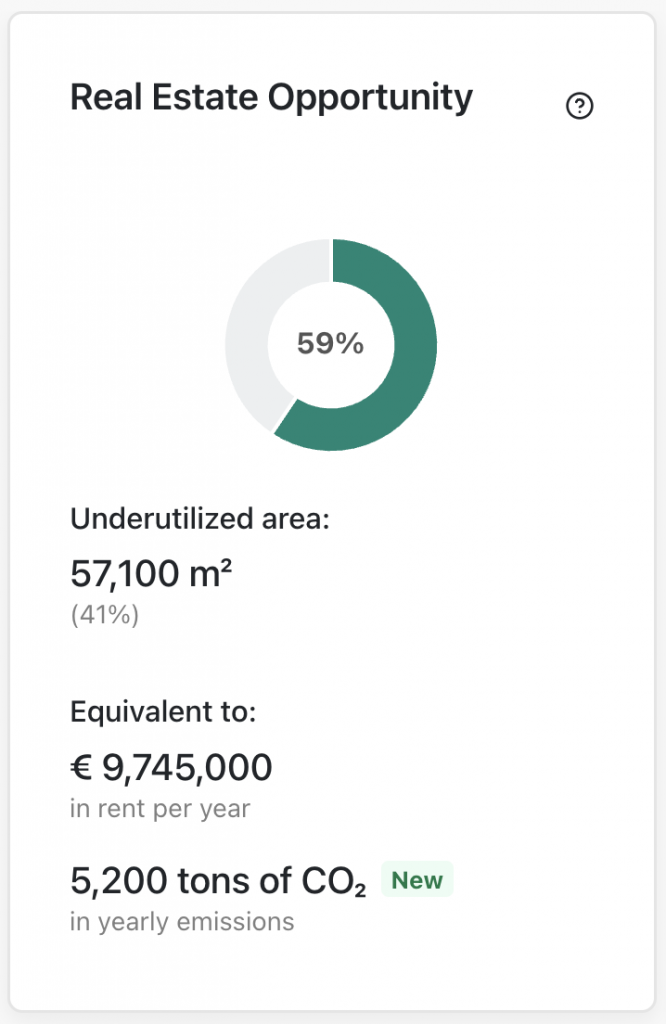

To boost the visibility and accessibility of these conversations within organizations, Basking has introduced a new element of the dashboard, offering a potential CO2 emission savings estimate at the portfolio and site level. Based on your real estate underutilization, this information can be used to assess the ESG potential from real estate optimization measures. Tangible, actionable data points are fundamental to the success of sustainability planning and reporting, and the spotlight is only getting brighter as investors, boards, regulatory agencies, and employees themselves are becoming more sensitive to global warming issues.

Contact us to learn more and see how this functionality can assist your decarbonization strategy.