Global Occupancy Benchmarking Report Q1 2022: Return to Office Begins

How is “The Great Return to Office” playing out around the globe? To find out, we looked at aggregated data from 100 offices (7 organizations, primarily in professional services and technology sectors) across the world with 39% of offices located in EMEA, 40% in North America, 10% in LATAM, and 11% in the APAC region.

By analyzing the occupancy data from Q1 2022, we found that employees are now using offices very differently from how they have been used in the past. With companies worldwide implementing remote and hybrid work policies, it has never been more important than now to measure workplace occupancy and space usage. Keep reading to find out how the occupancy stacks up in your region.

KEY FINDINGS

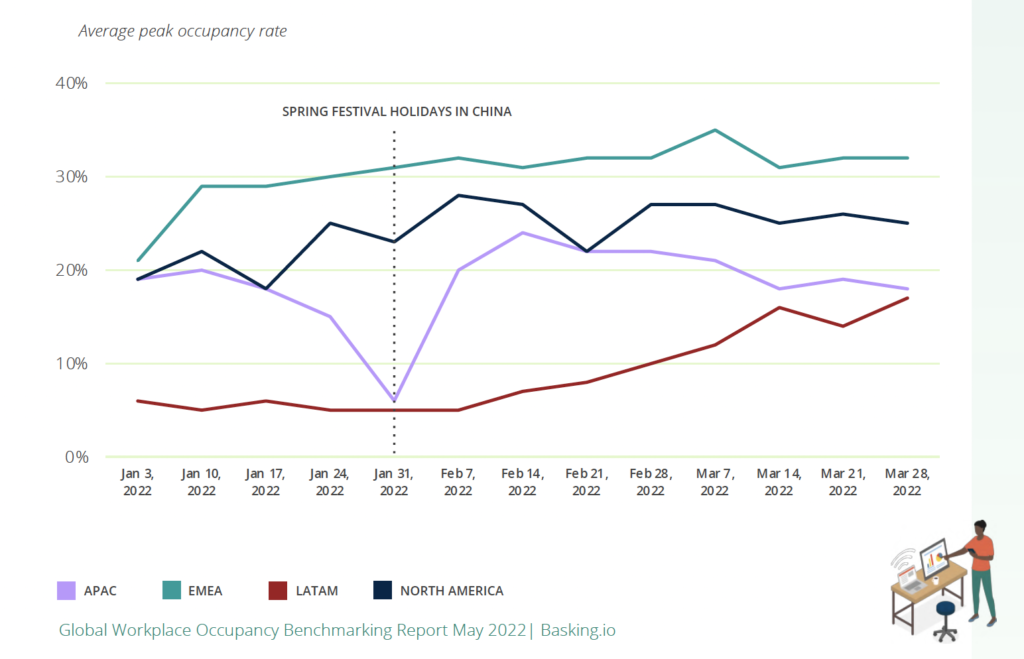

- Average peak occupancy rate was lower than 40% in Q1 2022 globally and was lowest (9%) in LATAM.

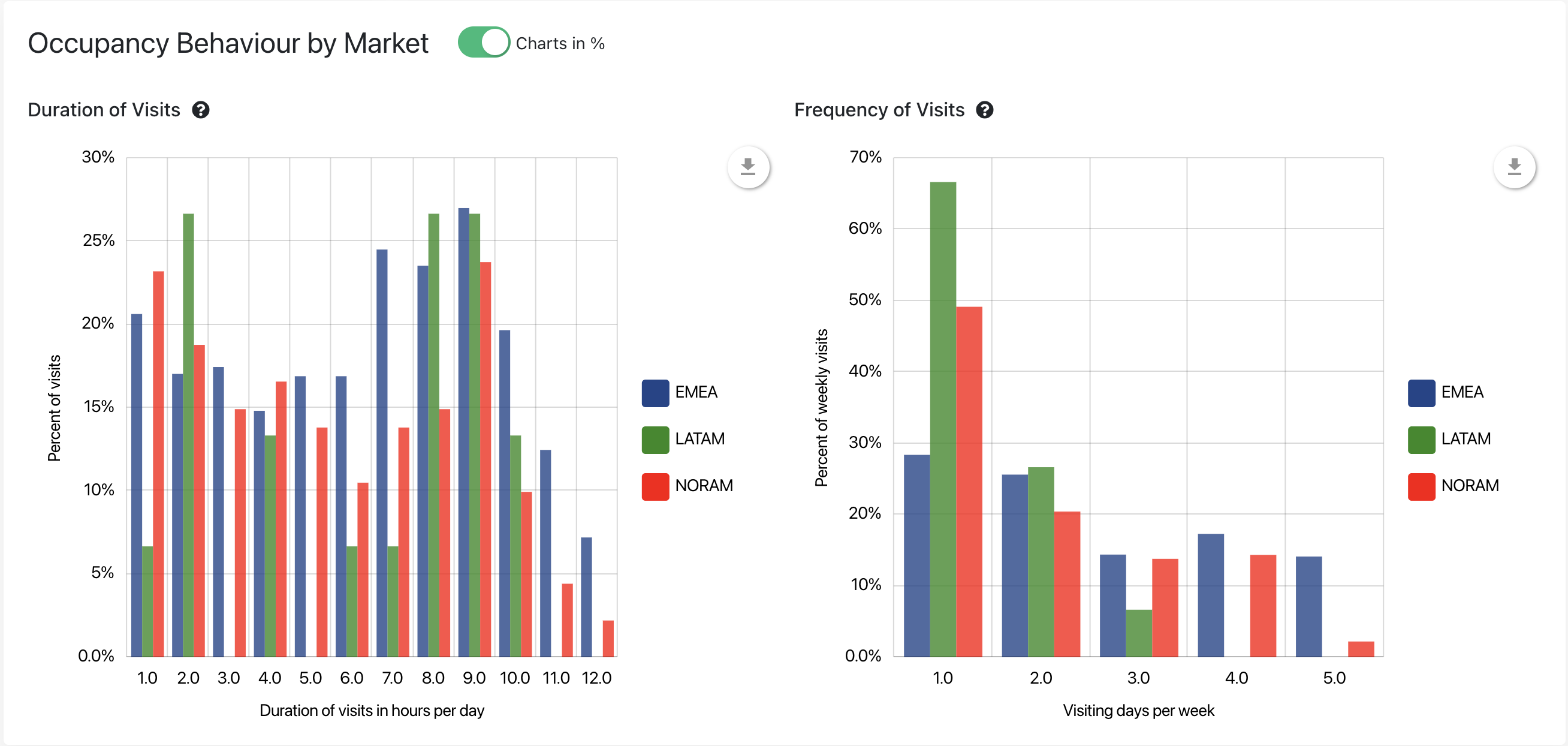

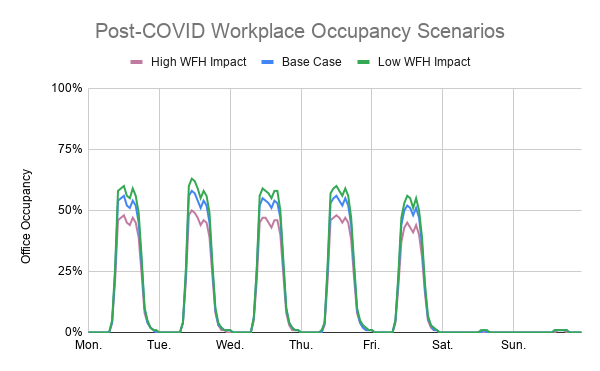

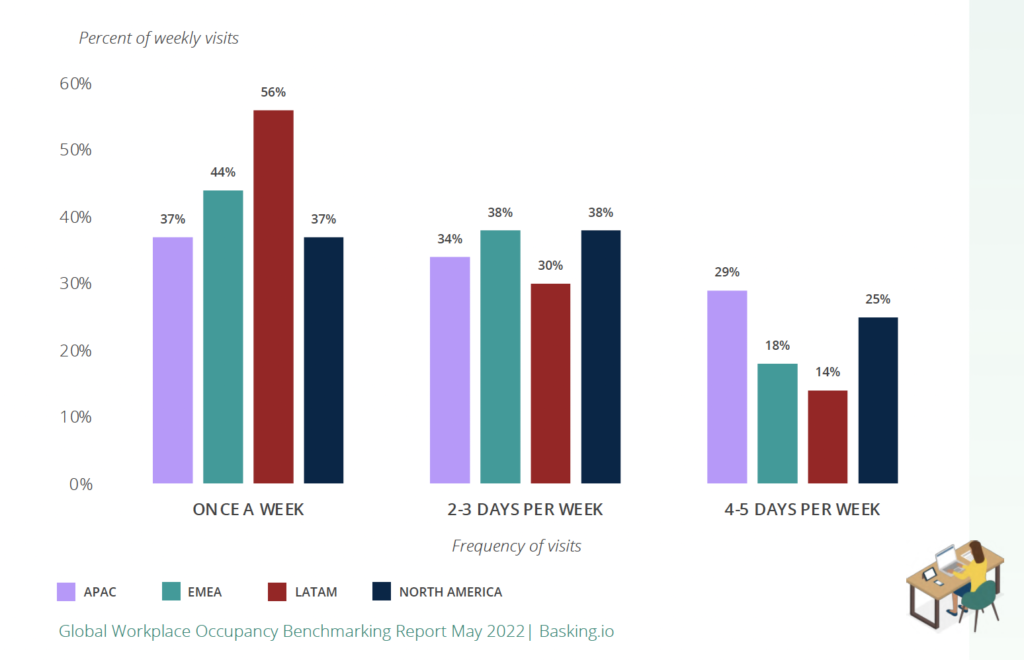

- People are now using offices in a non-traditional way. Globally, ~44% of weekly visits to the offices were for “once a week” with LATAM leading the category with 56% visits. Moreover, on average, ~37% of the global visits lasted for less than 6 hours.

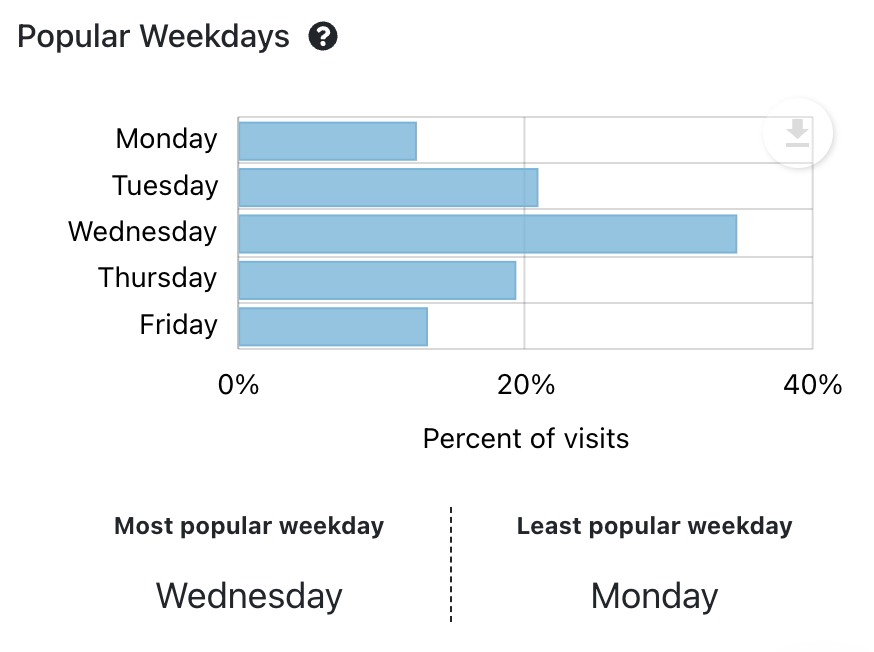

- Offices are facing midweek peak. Mondays and Fridays are less popular than other weekdays.

- Mega cities (17%) observed the lowest average peak occupancy rate in Q1 2022 compared to other city groups indicating that space utilization for an office is dependent on its city’s size.

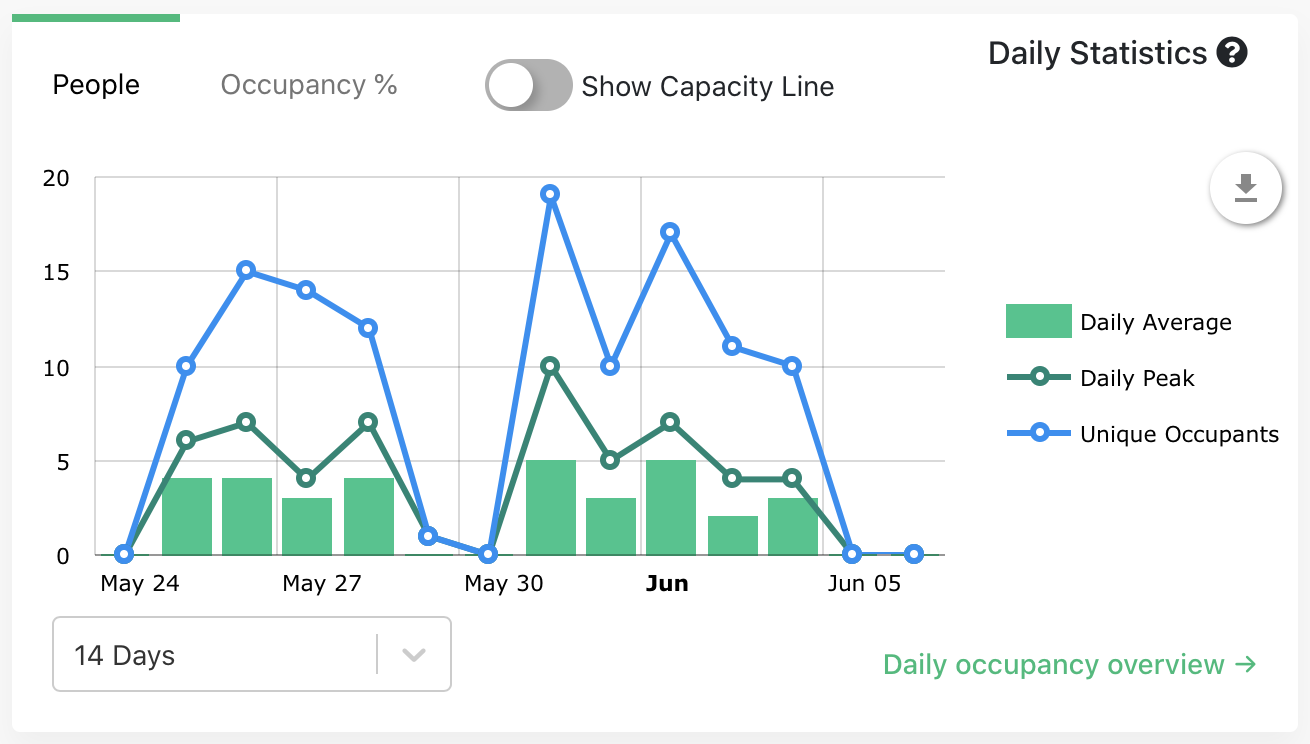

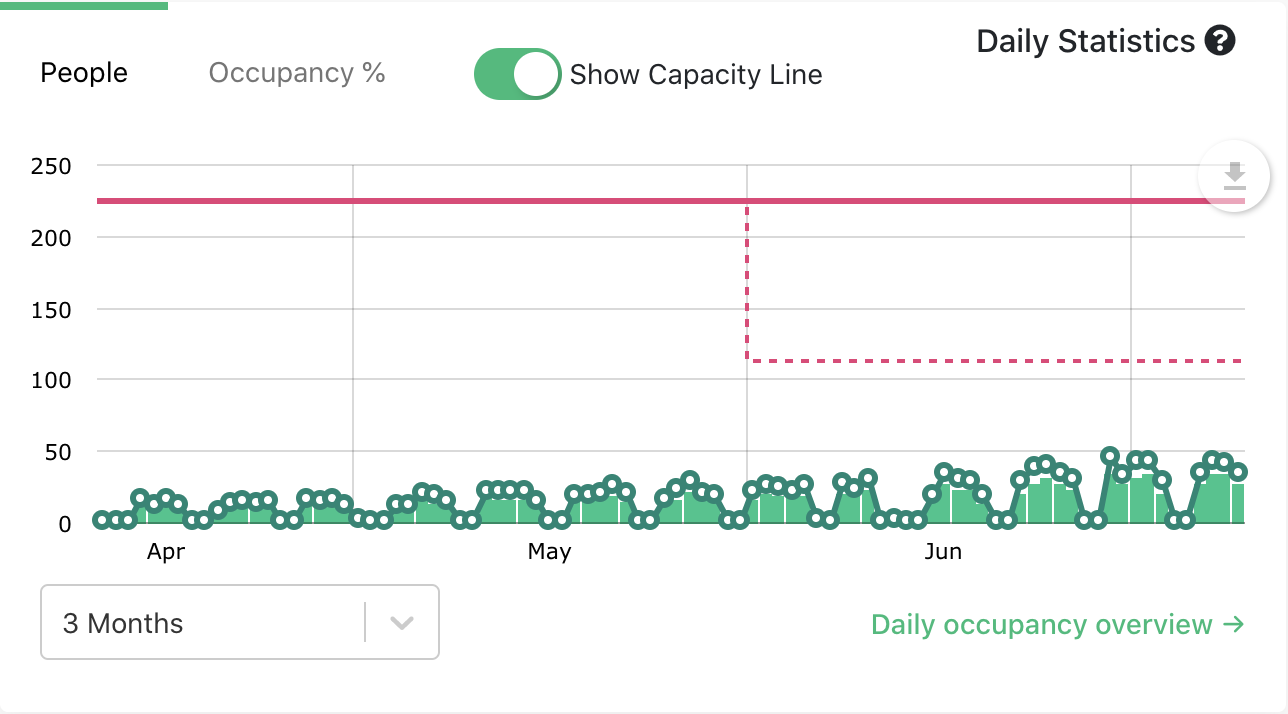

GLOBAL AVERAGE PEAK OCCUPANCY RATE WAS BELOW 40%

On average, the peak occupancy rate in Q1 2022 was highest in EMEA (31%), followed by North America (24%), APAC (18%) and LATAM (9%).

80% of the offices globally had average peak occupancy rate below 37% in Q1 2022

The average peak occupancy rate in LATAM offices increased by 204% from the first week (5%) of Q1 2022 to the last one (16%).

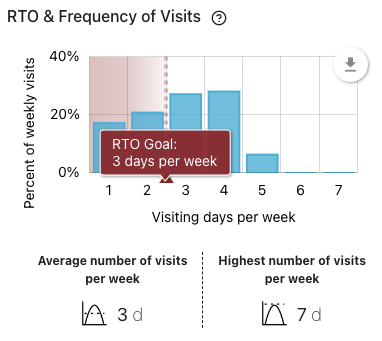

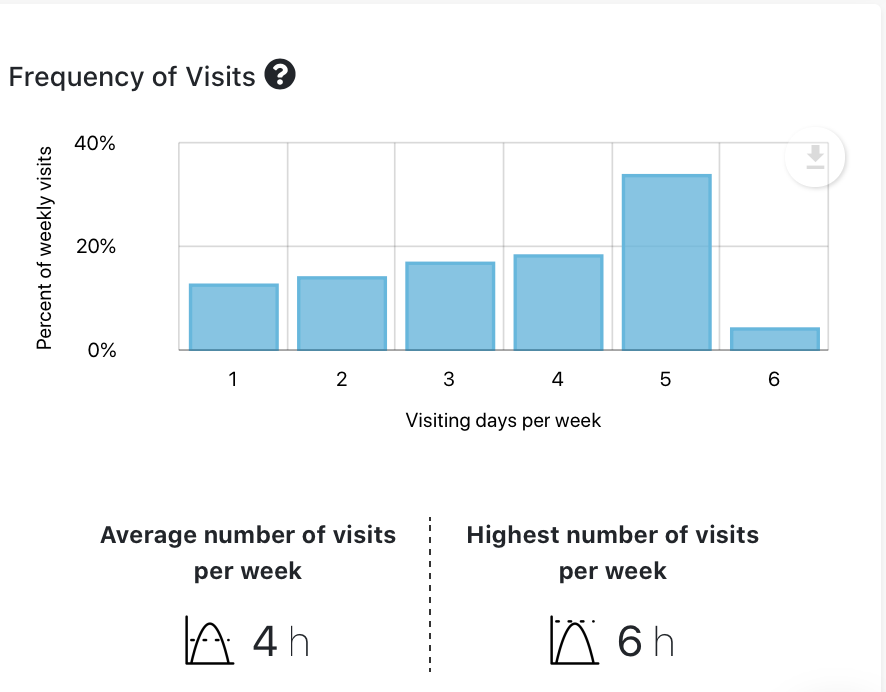

ONLY ~21% OF WEEKLY OFFICE VISITS GLOBALLY ARE FOR IN THE “4-5 DAYS PER WEEK” CATEGORY

Globally, ~44% weekly visits to the offices were for just “once a week”. LATAM (56%) stands out with the highest % of weekly visits in this category.

APAC (29%) observed the highest number weekly visits for “4-5 days”, followed by North America (25%), EMEA (18%) and LATAM (14%) With more firms implementing a “3 days in the office hybrid policy”, we’re expecting the “2-3 days per week” category to grow in coming months.

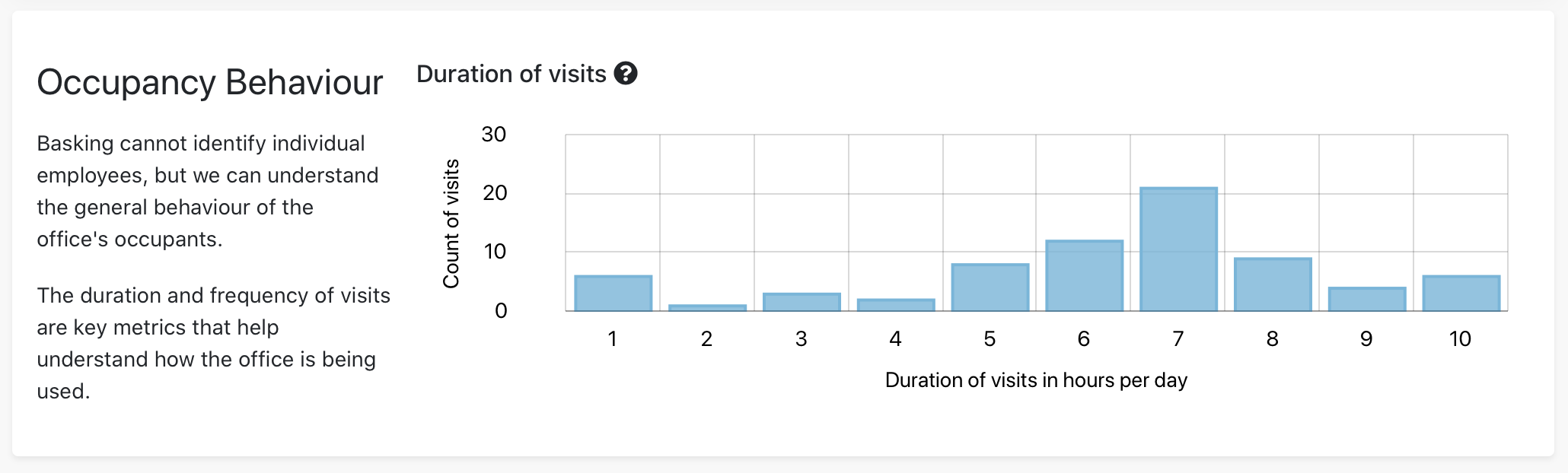

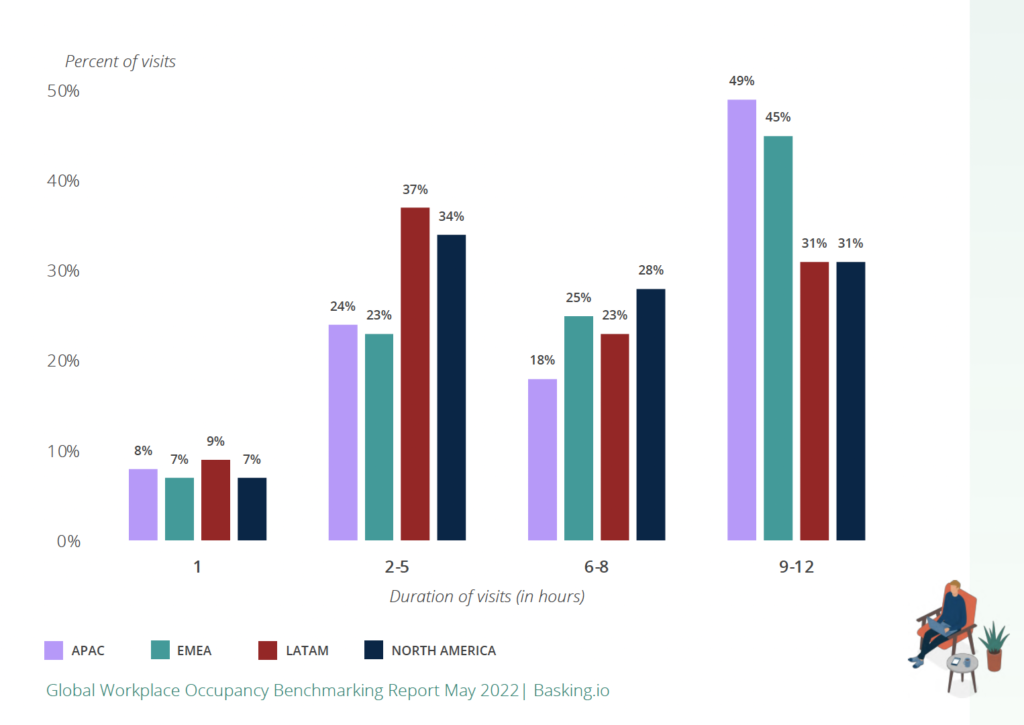

“8 HOURS PER DAY” NORM IS GONE

On average, 37% of the global visits lasted for less than 6 hours. In LATAM (37%) and North America (34%), most office visits lasted between 2 and 5 hours, whereas in APAC (49%) and EMEA (45%), most office visits lasted between 9 and 12 hours.

The shift from long to short office visits indicate hybrid work-culture and flexible work hours are the need of the hour.

You can find the report in full here. Get in touch if you have any questions!